Introduction

The hotel industry is one of the sub-sectors in the tourism sector envisioned to deliver on the 10 per cent annual economic growth as projected in the Kenya Vision 2030. Its contribution to real Gross Domestic Product (GDP) has been, on average, 1 per cent over the last 10 years. In addition, the industry directly employed 82,900 people and, together with trade, indirectly engaged 9 million people in 2019. At a disaggregated level, the industry contributed over 10 per cent to Gross County Products (GCP) for counties such as Kwale, Mombasa, and Nairobi in 2017, hence a key industry in both the National and County governments.

Following the outbreak of COVID19 pandemic, the National Government through the economic stimulus package set aside Ksh 2 billion as a soft loan to hotels. The loan was earmarked to support renovation and restructuring of business operations in the hotel industry. In addition, the industry also benefited from a tax incentive that saw Corporate Income Tax (CIT) reduce from a high of 30 per cent to a low of 25 per cent in 2020 under the fiscal policy stimulus, which was later reinstated to 30 per cent in January 2021.

Performance of Kenya Hotel Industry during COVID-19 Pandemic

The hotel industry is one of the sub-sectors that is heavily affected by the consequences of the COVID-19 pandemic. The effects are largely attributed to containment measures implemented to curb the spread of COVID-19 such as: the new norm of social distancing, which has reduced the hotel’s holding capacity; suspension of international flights such that the number of foreign tourists has declined; new norm of working from home, which has reduced the demand for hotel services especially the restaurant and conferences services; daily curfew hours, which has reduced the number of working hours; partial lockdowns within the country, which has reduced inter-counties’ tourists; and costly requirements for a COVID-19 compliance certificate to re-open businesses. These measures have slowed down the operations of the hotels and forced them to work under reduced capacity, or worse still close-down.

The industry’s growth trajectory came to a halt as it contracted by 9.3 per cent and 83.3 per cent in the first and second quarters of 2020[1], respectively. This was an all-time low from a growth of 13.1 per cent and 10.1 per cent in the first quarter of 2018 and 2019 and 15.4 per cent and 9.0 per cent in the second quarter of 2018 and 2019, respectively. The third quarter of 2020 saw an improvement of 30.4 per cent following the easing of government restrictions and resumption of most economic activities since July 2020. The positive outlook was, however, short-lived and prospects were shuttered when the third wave was witnessed in the country in April 2021, prompting new containment measures such as lockdown of five counties, extension of curfew hours, closure of bars, with hotels operating take-away services only.

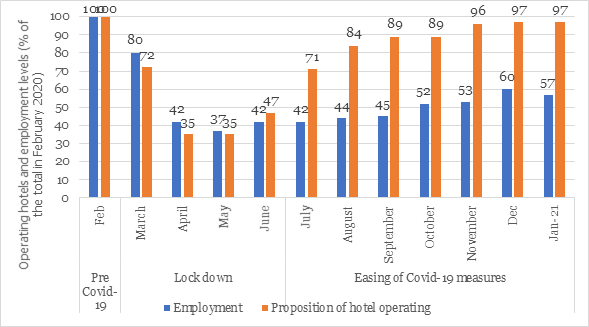

The contraction of the hotel industry was marked by a decline in the proportion of operational hotels during the COVID-19 pandemic period. For instance, operational hotels declined to 72 per cent in March 2020 and further to 35 per cent in May 2020 (Figure 1) reflecting pressure on the industry due to COVID-19 measures. However, with the easing of COVID-19 measures and the opening of the economy in July 2020, the industry has been on a recovery journey, albeit slow until when a partial lockdown was announced in April 2021. On average, 97 per cent of the hotels were operating in January 2021 compared to 89 per cent in October 2020 and 71 per cent in July 2020. Despite the notable recovery until January 2021, the number of operational hotels is projected to have reduced further to below 97 per cent in March-April 2021 following the COVID-19 protocols for hotels in Nairobi, Kajiado, Machakos, Nakuru, and Kiambu to provide only takeaway services.

The hotel industry is projected to constitute the majority of the 1.72 million people who lost their jobs due to COVID-19 pandemic. As indicated in Figure 1, the industry experienced high unemployment rates as 67 per cent of the hotel industry employees lost their jobs in May 2020. However, due to the easing of COVID-19 restrictions and increase in demand for hotel services during the Christmas festive, most staff resumed jwork, leading to an increase in employment to 60 per cent towards the end of the year.

Figure 1: Proposition of hotels operating and employment level during the COVID-19 Pandemic

Data Source: Central Bank of Kenya Report, Nov 2020 & Jan 2021

Despite the rebound in operating hotels, utilization of hotel facilities such as bed occupancy rate, restaurant services, and conference facilities has remained low. For instance, there was a sharp decline in utilization of conference services from 60 per cent in February 2020 to 40 per cent in March 2020 when the first case of COVID-19 was reported, and further to an average of 6 per cent between April and June 2020. The contraction in the utilization of conference facilities prevailed to July 2020 when it began to grow marginally, rising to 17 per cent in November 2020. Similarly, both the utilization of restaurant services and bed occupancy rate declined from 66 per cent in February 2020 to 37 per cent in March 2020 and further to an average of 11 per cent between April and May 2020. The utilization of restaurant services and the bed occupancy rate registered negligible growth from July 2020 to 28 per cent and 22 per cent in November 2020, respectively. This implies that the tourism sector is unlikely to attain the projected hotel-room revenue growth rate of 12.1 per cent and 9.4 per cent[1] in 2020 and 2021, respectively, as forecasted by PricewaterhouseCoopers (PwC).

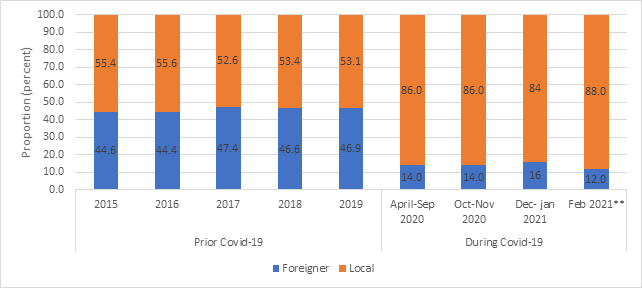

A comparison of local and foreign clientele (Figure 2) shows that domination of local clients during the pandemic compared to pre-COVID-19 period when the difference between the local and foreign clients was marginal. The decline in the number of foreigners from 127,087 in January 2020 to an average of 6,080 between April and September 2020, 47,406 in December 2020, and 35,052 in February 2021 during the pandemic presents an opportunity for the hotel industry to re-think their business model, including enhancing their focus on the domestic market.

Figure 2: Hotel clientele

Data Source: Kenya National Bureau of Statistics (Various), Economic surveys and Central Bank of Kenya Report, 2021

Should the hotels adopt a different business model?

The prevailing COVID-19 situation has exposed the unsustainable business models adopted in the hotel industry. Traditionally, star-rated hotels have been viewed to be more resilient and adaptive to shocks compared to small urban eateries and restaurants. However, COVID-19 has exposed their vulnerability as a result of overdependence on foreign clients and unsustainable pricing models. As presented in Figure 2, around 86 per cent of hotel clients were local even after resumption of flights in August 2020. This group of hotels are also known to depend on conferences and events, which were all brought to a halt to contain the spread of the virus. The pandemic has resulted to closure of hotels such as the Intercontinental Hotel, Radisson Blu Hotel Upper Hill, Norfolk Fairmont and the Nairobi’s Tribe Hotel to date, while some that had temporarily closed such as Ole-Sereni, Dusit-2 have resumed their operations.

The restaurants and eateries practice a different business model that meets the needs of financially strained clients.This includes fair pricing and affordable packages that have seen their continued survival during this tough period. The Chicken Inn and Pizza Inn outlets, for instance, have friendly offers during specific days of the week such as Tuesday and Thursday where Pizzas are sold on the basis of buy one get one free. This strategies attract more clients thus increasing the hotels’ sales turnover. Majority of the restaurant outlets offer delivery services that give them a competitive edge especially during the COVID-19 period. The hotels have also thrived through varieties and packages designed to meet the needs of every customer by offering the same product in different proportions and sizes. In addition, adjusting the product and service mix by star-rated hotels to serve the needs of the domestic market can be another breakthrough for the sector. The food cost for menus served in starred hotels is high, which translates to the relatively higher prices compared to hotels and eateries. Serving simple and traditional food such as “Mukimo and Githeri” that have a lower food cost will imply lower pricing, thus attracting more customers.

Sarova Hotels are reengineering their business model to reach out to the low-end customers. They have opened two restaurants in Nairobi, in the Central Business District and Westlands, diversifying from the trademark hotels and accommodation business to restaurant model aimed at cushioning the hotel amid the pandemic. The Serena Hotel Group is also known for establishing lodges, resorts, hotels and camps in different parts of the country to serve the needs of various markets. However, tapping into the takeaway market has been a challenge for starred hotels given that most clients meet in the facilities for meetings, conferences and workshops, which demand real-time services. The physical setting of starred hotels also limits the takeaway strategy given that motorbikes are used for delivery services, which may not be appealing for this kind of setup. As such, this niche would be feasible only if these hotels adopt the restaurant model, such as what Sarova has done to tap into this niche market.

The arrival of 1.02 million COVID-19 vaccines doses in Kenya on 3rd March 2021 was timely, though not enough for the 47.56 million Kenyans. The country is already experiencing the third wave of COVID-19, and should the pandemic persist, the industry may experience more layoffs, reduced clients and decline in utilization of the hotel facilities. This will delay full resumption of hotel operations and further slowdown the efforts to enhance the contribution of the industry to the economy.

It is therefore, critical for the state and non-state agencies to explore innovative strategies to enhance resilience and incentivize the industry during the pandemic to sustain the growth trajectory.

Authors: Peris Wachira, Young Professional, Private Sector Department

Rufus Kandie, Young Professional, Productive Sector Department

[1] Hotel’s outlook: 2019–2023 Future resilience https://www.pwc.co.za/en/assets/pdf/hotels-outlook-19-2023.pdf

[1] KNBS (2020) Quarterly GDP Report, 2020. Accessed from https://www.knbs.or.ke/?page_id=1591.