Digital credit leverages on instant, automated and remote processing of micro loans, making access to credit fast and convenient. The availability of digital credit together with increased ownership of smart phones with downloadable apps for accessing digital credit contributed to a rapid growth in the uptake of unregulated digital credit in Kenya. A research report by the Competition Authority of Kenya[1] in 2021 reveals that the average loan size by digital lenders ranges from Ksh 4,034 to Ksh 9,815.

Various FinAccess household surveys show that the adult population in Kenya borrowing from unregulated digital lenders increased from 200,000 in 2016 to 2 million individuals in 2019. The number of borrowers, however, slumped to 600,000 by 2021, possibly due to adverse impacts of the COVID-19 pandemic, which was compounded by increased negative listing of borrowers by Credit Reference Bureaus (CRBs) due to income disruptions that affected loan repayments. The 2021 FinAccess household survey shows that 2.0 per cent of the adult population in Kenya use loans from unregulated Digital Credit Providers (DCPs), compared to mobile banking-enabled lenders at 8.6 per cent and Mobile Network Operators (MNOs) at 16.9 per cent. The use of digital credit is higher among the youth (18 to<35 years), and individuals residing in urban areas and those with more years of education. This suggests that the use of digital credit closely mirrors the use of smartphones among the youth, those residing in urban areas and those with more years of education. For instance, the proportion of youths (18 to <35 years) using smartphone is about 1.7 times more than non-youth population (≥35 years), while the proportion of individuals residing in urban areas using smartphone is 2.4 times that residing in rural areas.[2] The penetration of smartphones accelerated from July 2020 following a smartphone device financing plan by Safaricom (Lipa mdogo mdogo initiative) as a strategy to attract new customers.[3] Other factors contributing to high penetration of smartphones include availability of cheap smartphones, and improved ICT infrastructure.[4] The penetration[5] of smartphones increased from 53.4 per cent in September 2021 to 60.9 per cent as at June 2023.

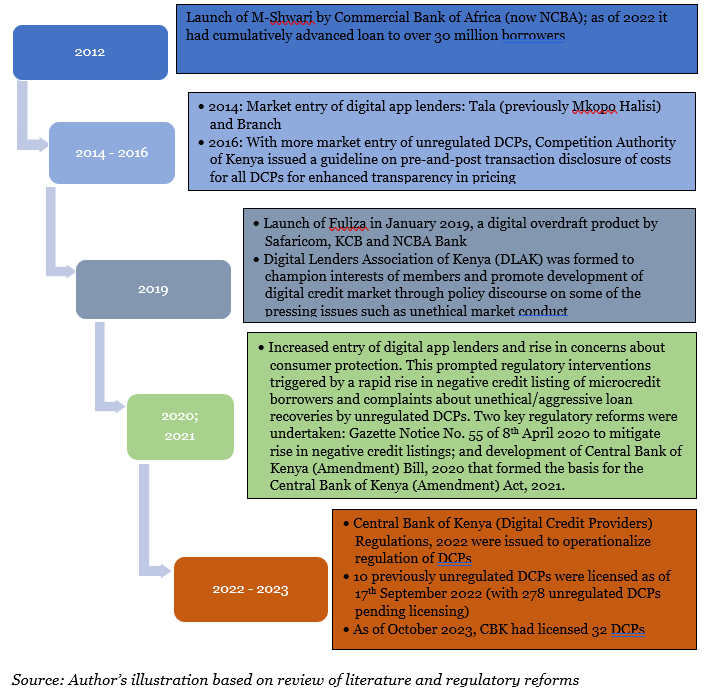

As a short-term intervention to relieve microcredit borrowers from the burden of negative credit listing, the Central Bank of Kenya (CBK) issued Gazette Notice No. 55 of 8th April 2020 to remove negative listings by Credit Reference Bureaus (CRBs) for amounts less than Ksh 1,000 and prohibit non-bank DCPs from participating in credit information sharing system. As a long-term intervention, the government embarked on legal and regulatory reforms for regulating all digital lenders in the country to curb predatory lending, which was seen as exploitative in interest rate charges and aggressive loan recovery strategies.

Digital Credit Market Development

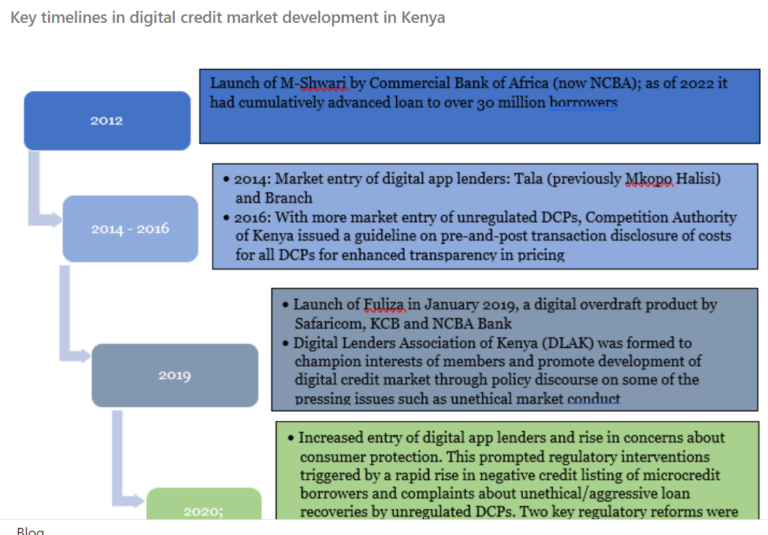

Kenya’s digital credit market developments are provided in the figure below, with the launch of M-Shwari in November 2012 by Commercial Bank of Africa (currently NCBA) and market entry of the unregulated digital app credit providers, Mkopo Halisi (later renamed Tala) and Branch in 2014. Thereafter, there was a rapid development in the digital credit industry, triggering legal and regulatory interventions especially from 2020 onwards. The rapid market entry of DCPs is attributed to demand for short-term credit that is easy to access, and low entry and exit barriers in terms of regulations and capital requirements. A study by Financial Sector Deepening (FSD) Kenya reports that between September 2018 and April 2019, about 65 digital credit apps exited the market while 47 entered the market,[6] suggesting ease of market entry and exit.

Key timelines in digital credit market development in Kenya

Regulatory Reforms on Digital Credit

Prior to regulatory reforms in 2020, the digital credit market in Kenya was clustered into three broad categories, based on the nature of the supplier of the credit. These included unregulated fintech lenders that leverage on smartphone apps (e.g., Jijenge Credit Ltd, Sokohela Ltd), mobile banking-enabled lenders (e.g. M-Shwari, KCB M-Pesa, MCo-opCash), and digital overdraft facilities by Mobile Network Operators (MNOs) in form of advance airtime or other forms of overdraft to complete financial transactions such as paying bills or buying goods (e.g., Safaricom’s Fuliza and Airtel’s Kopa Credo).

To mitigate the burden of a rapid rise in negative credit listings, CBK issued Gazette Notice No. 55 of 8th April 2020 to remove negative CRB listings for amounts less than Ksh 1,000 and prohibit non-bank DCPs from participating in credit information sharing system.

The DCPs that operate as banks or MNOs fall under the regulations or oversight provided by the Central Bank of Kenya, Communications Authority of Kenya, Competition Authority of Kenya, and Office of the Data Protection Commissioner. The Central Bank of Kenya (Amendment) Act,[7] 2021 sought to bring on board previously unregulated fintech DCPs that leverage on smartphone apps. Subsequently, the complying fintech DCPs were brought under the supervision of CBK and adherence with the requirements of Section 19 of the Data Protection Act, 2019; Part VII of the Consumer Protection Act, 2012, and provision of the Proceeds of Crime and Anti-Money Laundering Act No. 9 of 2009. Section 19 of the Data Protection Act, 2019 provides for requirements such as descriptions of personal data to be processed, descriptions of purpose for which personal data is to be processed, a general description of the risks, safeguards, security measures for protection of personal data; and measures to indemnify data subjects from unlawful use of data by the data processor or data controller. Part VII of the Consumer Protection Act, 2012 relates to credit agreements such as disclosure of terms of credit and protection of borrowers from excessive interest and non-interest charges.

Towards operationalizing the amended Central Bank of Kenya Act in regulating the digital lenders, the Central Bank of Kenya (Digital Credit Providers) Regulations, 2022 were issued to provide for good corporate governance practices by DCPs. These include the requirements that a person holding the position of a significant shareholder, director, chief executive officer or a senior officer of DCP meet the fit and proper criteria as outlined therein. For directors and senior officers, these criteria, for instance, include possession of relevant qualifications, knowledge, skills and experiences, and previous conduct of the persons.

Challenges that Underpinned the Regulatory Reforms of DCPs

Notwithstanding the ease of access, the default rate has been high among digital credit borrowers, with severe implications for negative listings at CRBs and aggressive loan recoveries that have been viewed to be unethical, including coercing social networks such as families and friends. The 2021 FinAccess Household Survey indicates that 50.9 per cent and 46.3 per cent of borrowers of loans through mobile banking and digital app loans reported to have defaulted repayment.[8] These default rates were high compared to those who borrowed from microfinance institutions (30.8%), government credit institutions (22.5%), banks (22.1%), Saving and Credit Cooperatives – SACCOs (16.0%), or even chamas – social groups (34.4%).

The 2021 FinAccess Household Survey further shows key concerns raised by borrowers of digital app loans, including negative listing by CRBs (40.6%), overly loan recovery measures such as listing on social media sites and ‘pushy’ messages on social networks such as friends and family members (33.6%), and unexpected charges (31.8%).

Pricing and transparency were also key concerns. A study by the Competition Authority of Kenya in 2021 established that average Annual Percentage Rate (APR) on loans among four unregulated DCPs was 280.5 per cent.[9] Consequently, there was a public outcry on the expansion of unregulated digital credit. Beyond the consumer outcry, there were also other public policy concerns, such as the growing number of unregulated digital credit providers, including risks of money laundering and personal data abuse.

The public policy concerns led the government to initiate regulatory and supervisory reforms for Digital Credit Providers (DCPs), also commonly known as digital lenders. The Central Bank of Kenya (Amendment Act) 2021, which became effective on 23rd December 2021 empowers the Central Bank of Kenya (CBK) to license and provide oversight of the previously unregulated DCPs. Subsequently, in line with the amended Central Bank of Kenya Act Cap. 491, the CBK issued the Legal Notice No. 46 of the Central Bank of Kenya (Digital Credit Providers) Regulations, 2022 on 18th March 2022. All the existing unregulated DCPs were given a grace period of 6 months from the date of publication of the Regulations (i.e., by 17th September 2022) to apply to CBK for a license. New DCPs that subsequently come on board are expected to seek CBK licensing.

Policy Issues and Options Post-Legal and Regulatory Interventions

The legal and regulatory interventions were geared towards curbing predatory lending practices by the unregulated digital app DCPs. These are to be achieved through enhanced transparency in lending practices, improved corporate governance, measures to curb undisclosed interest and other charges and notification of borrowers prior to negative reporting to CRBs. There are also measures geared towards anti-money laundering for integrity and security of the financial system. Other measures include protection of data and privacy of digital credit borrowers. Thus, the measures provided so far are anchored at the interphase of the role of CBK, Competition Authority of Kenya (CAK), and Office of the Data Protection Commissioner (ODPC). The synergy among the three institutions (CBK, CAK, ODPC) is therefore vital as articulated in the Central Bank of Kenya (Digital Credit Providers) Regulations, 2022.

Most of the measures so far are supply-side oriented and opportunities exist in addressing the demand-side issues. This includes financial literacy among the individuals who may still engage in multiple borrowings of digital credit, especially where they are intended for consumption purposes as opposed to productive investments such as business, education, and healthcare. The FinAccess household surveys report that the dominant usage of digital credit is for consumption and meeting emergencies compared to borrowings from banks and SACCOs that are used dominantly for investments in businesses/farms. Thus, it is imperative to fast-track measures towards improving financial literacy on the demand side of the digital credit market. This will include developing financial literacy policies, strategies and programmes that can promote disciplined use of easy to access financial services, among other benefits. This can be a priority for the National Treasury, particularly in terms of policy development. Synergies among the financial sector regulators will also be vital in entrenching financial literacy programmes.

That said, there are complementary opportunities on the supply-side. The areas of focus on the supply-side can include how the legal and regulatory measures will be complied with by the targeted DCPs. For instance, bulky, complex, and small-font terms and conditions are usually constraints to borrowers in terms of internalizing the terms and conditions on aspects such as pricing, penalties, and duration of payments. Digital lenders need to, therefore, consider simplifying terms and conditions and displaying them visibly before and after a borrower accepts the loan. The cost of digital credit also needs to be viewed from a holistic perspective, including interest rates, other charges and fees and transfer fees from a virtual wallet to mobile wallet account and vice versa.

Further, from the supply side perspective, an issue of interest is assessing the impact of the legal and regulatory measures on performance of DCPs to gain insights that can inform further areas for reforms so as not to curtail development of digital credit markets that can still bridge gaps where other conventional credit market instruments may not serve the target consumers. Compilation of quality data on performance of DCPs, access and usage of digital credit data is particularly important towards achieving this goal. Timely collation and analysis of data by the CBK, CAK and ODPC are vital for policy monitoring of the progress. An issue of interest is how the legal and regulatory reforms will affect borrowings from DCPs vis a vis conventional credit channels from banks, microfinance institutions, SACCOs or even informal sources. These can be issues for consideration in the next phase of FinAccess or other similar surveys.

[1] https://www.cak.go.ke/sites/default/files/Digital_Credit_Market_Inquiry_Report_2021.pdf

[2] Based on the 2021 FinAccess household survey

[3] Communications Authority of Kenya; First Quarter Sector Statistics Report for the Financial Year 2020/2021

[4] Communications Authority of Kenya; First Quarter Sector Statistics Report for the Financial Year 2021/2022

[5] Calculated as number of smartphones as a percentage of the national population.

[6] Digital Credit Audit Report: Evaluating the Conduct and Practice of Digital Lending in Kenya (FSD Kenya, November 2019): https://s3-eu-central-1.amazonaws.com/fsd-circle/wp-content/uploads/2019/11/13160713/Digital-Credit-audit-report.pdf

[7] This regulatory initiative resulted from the Central Bank of Kenya (Amendment) Bill, 2020

[8] The default related to any event in relation to missing a scheduled repayment, making late repayments or not making repayments at all.

[9] Report on the Competition Authority of Kenya Digital Credit Market Inquiry (Competition Authority of Kenya, May 2021): https://www.cak.go.ke/sites/default/files/Digital_Credit_Market_Inquiry_Report_2021.pdf

Author: Adan Shibia, Senior Policy Analyst, Private Sector Development Department