Introduction

Kenyans living in the diaspora are integral to Kenya’s economic landscape, contributing significantly to the nation’s growth and development. Through remittances, investments, and the sharing of knowledge and skills, they play a pivotal role in achieving Kenya’s vision of becoming a globally competitive and prosperous nation. In fact, remittances alone have surpassed income from tourism and exports, highlighting their immense impact.

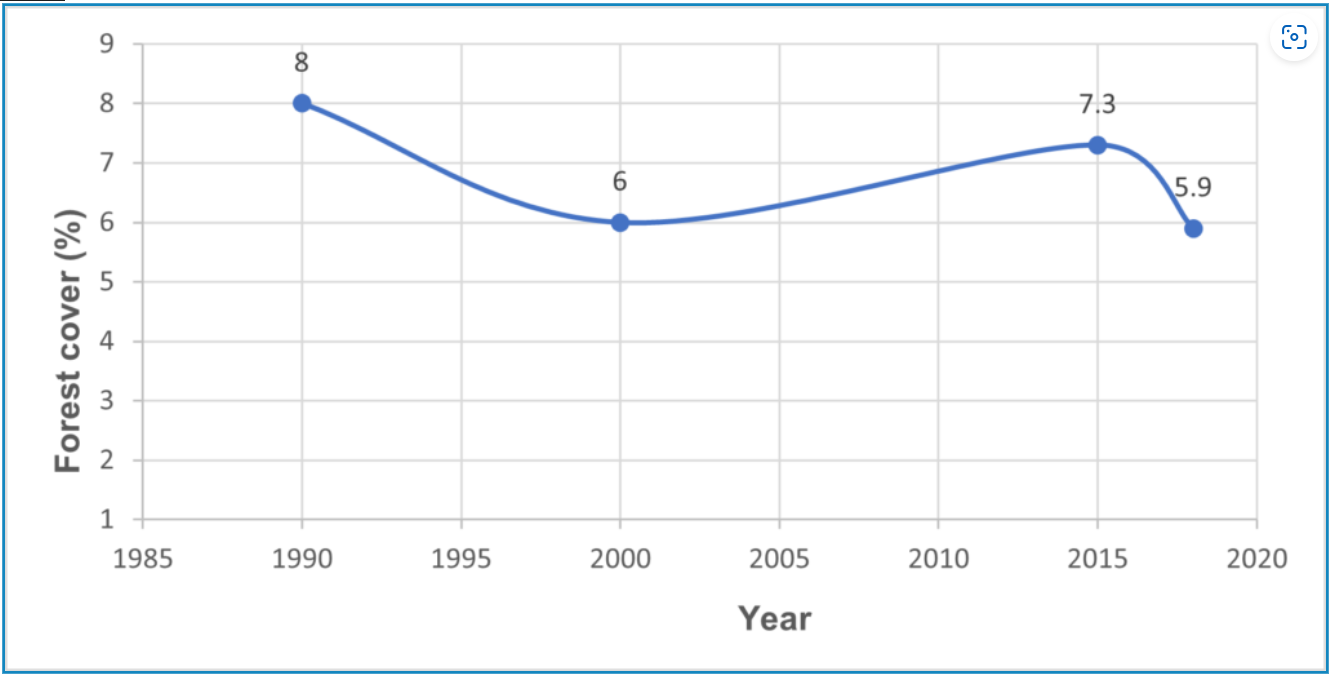

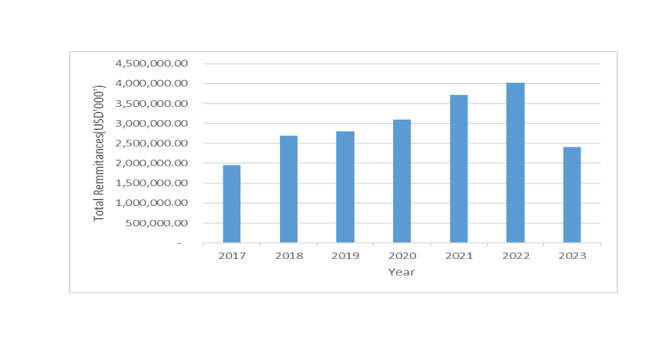

Recognizing the value of diaspora contributions, the government acknowledges their role in fostering economic and social progress. Beyond informal channels, diaspora investments span various sectors, including technology, real estate, tourism, and export-based enterprises. Additionally, their expertise and skills are invaluable, particularly in education and environmental initiatives. The growth in remittance inflows, reaching a record high of US$ 4.027 billion in 2022, as shown in Figure 1 below, reflects the diaspora’s continued support of the economy, contributing to foreign exchange reserves and the country’s overall GDP.

Figure 1: Total diaspora remittances, 2015-2022 (Ksh ‘000’)

Source of Data: Central Bank of Kenya

Factors Constraining Diaspora Investments

Despite the diaspora’s contribution, UNCTAD (2021) revealed that diaspora investors face inadequate knowledge/low awareness of investment opportunities in Kenya, which affects potential investors’ ability to make informed investment decisions. In addition, insufficient networks and connections with potential business partners or stakeholders poses a challenge in identifying suitable investment opportunities.

Concerns about complex administrative processes deter diaspora investors from engaging in formal investment channels. This is due to the lengthy and cumbersome business registration and permit acquisition procedures. Additionally, limited local partnerships and networks make it difficult for diaspora investors to find suitable investment opportunities. The World Bank’s Ease of Doing Business Index provides evidence of the challenges businesses face in Kenya, including those operated by diaspora investors.

The relatively high cost of sending remittances from abroad to Kenya also impacts the available funds for investment purposes. According to the World Bank, remittance transfer costs to Kenya remained high at 8.45% in 2020 (World Bank, 2020). These elevated costs reduce the capital available for investment, discouraging diaspora investors from utilizing their resources for productive investments. Despite these challenges, the Kenyan diaspora continues to play a crucial role in driving economic growth and development, contributing through remittances and investments in family businesses and properties. As a result, the diaspora community has become an increasingly important stakeholder for the government, both economically and politically. Their investments can potentially address the financing gap in development and generate additional funds for infrastructure, energy, and other national priorities.

Policy Interventions in Promoting Diaspora Investments and Emerging Issues

Executive Order 1/2023 saw the establishment of the State Department for Diaspora Affairs, whose mandate is to harness the potential of the Kenyan Diaspora for social-economic development through networking and information sharing, and by supporting employment and entrepreneurship opportunities, developing incentives for remittances, and facilitating investment and technology transfers. These efforts create an environment conducive to diaspora investments and contribute to Kenya’s economic growth and development.

Kenya recognizes the vital role played by diaspora as cultural and brand ambassadors for the country and possessing skills essential for national development. The Kenyan Government has established dedicated diaspora associations and diaspora portals for each Kenyan embassy and consulate and includes a skill-matching programme. The Kenya Diaspora Policy also proposed the establishment of the National Diaspora Council of Kenya (NADICOK) to safeguard diaspora interests. Several diaspora meetings and events have been held in Kenya and abroad to continue the discussion of ways of implementing policies and recommendations. For example, the ninth edition of the Kenya Diaspora Homecoming Convention (KDHC) was held in Nairobi in December 2022 on the theme of “Inclusive Growth–Leveraging Diaspora Resources”. The issue of exploring ways in which the government can bolster diaspora remittances and investment opportunities was discussed.

The Central Bank of Kenya has identified the ease of sending money back home as a major factor in the sharp growth of Kenyan remittances, and it has also developed a range of financial products targeting the diaspora, including some successful M-Akiba, infrastructure bonds and diaspora bonds. The expansion of the popular M-Pesa service beyond Kenya’s borders is also helping with direct cash transfers on mobile, making it easier for the millions who actively use mobile money to receive money instantly from relatives abroad. Local banks have also entered partnerships with remittance service providers that allow them to handle larger volumes of inflows. To channel more of the diaspora’s money into development projects, the government in 2021 introduced an investment fund for citizens living overseas to help provide a safe and regulated investment body for Kenyans living overseas.

However, the implementation of NADICOK has been pending, limiting the operationalization of the Kenya Diaspora Policy. The national diaspora disaggregated database has not been finalized as the only database available is at the Kenya embassies and not all members in the diaspora have been registered with the diaspora associations. This has led to loss of mutual benefit associated with the diaspora population for both the government and the diaspora themselves due to inaccurate and unreliable data on the demographic profiles of Kenyans.

Conclusion and Recommendations

Kenyan diaspora is a source of significant resource flows through remittances and a crucial contributor to social investments. Given the high potential for diaspora remittances, the government needs to build a more robust understanding of how private resources can be invested. In addition, there is need for the government to promote institutional engagement with the diaspora and establish an economic environment geared towards promoting investment through financial incentives. Among the recommendations that can be considered are the following:

- The Ministry of Foreign and Diaspora Affairs (MOFDA) in collaboration with the Kenya Investment Authority and Diaspora associations could develop and implement targeted investment awareness programmes, including investment seminars, workshops, and online platforms, to provide diaspora investors with comprehensive information about sectors, business regulations, and available support systems.

- The government could establish platforms and networks that can help facilitate connections between diaspora investors and local businesses, entrepreneurs, and stakeholders, and promote networking events, business matchmaking programmes, and investment forums to create opportunities for collaboration and partnerships.

- The government, through the Central Bank of Kenya, encourages the development of flexible and innovative financial products specifically designed to attract diaspora investors and seek to negotiate lower transfer fees and explore innovative financial solutions. Financial institutions must also strengthen programmes promoting diaspora investments, including online platforms and accelerators.

- By allocating the necessary resources and establishing clear roles and responsibilities, The MOFDA can expedite the operationalization of the National Diaspora Council of Kenya (NADICOK). They also provide adequate support to ensure effective representation and protection of diaspora interests. In addition, there is need to invest in comprehensive data collection and research initiatives to gather accurate and reliable information on diaspora investments, remittances, skills, and expertise. This will help identify investment trends, target areas for intervention, and evaluate the impact of diaspora-related policies and programmes.

Authors: Ann Muema , KIPPRA Young Professional

Catherine Nyaboke, KIPPRA Young Professional