Introduction

The Constitution of Kenya (2010) ushered in a transformative era of inclusive development and devolved governance. As part of the government’s efforts to address marginalization, the Equalization Fund was established through Article 204, ensuring that 0.5% of the National government’s annual revenue is specifically allocated to marginalized areas. The Commission on Revenue Allocation (CRA) is responsible for identifying these marginalized areas based on a criterion outlined in Articles 260 and 216. The fund aims to catalyze development in historically marginalized regions by providing financial resources for the construction of infrastructure such as roads, schools, hospitals, piped water systems, sewerage systems, and electricity.

Marginalized regions in Kenya have over time experienced inadequate infrastructure development, resulting in limited economic opportunities and enduring poverty. Despite the establishment of the Equalization Fund to tackle these challenges, significant obstacles persist, such as constraints in national revenue, delays in fund disbursement, and unclear monitoring and evaluation systems. Consequently, effective implementation of the fund is hampered, leading to sluggish progress in infrastructure development, piling up of unpaid bills, deterioration of existing infrastructure, unequal access to services, and existence of unfinished projects. Consequently, urgent, and effective policies and governance interventions are necessary to address the gaps. The evaluation of the current implementation progress of the fund will provide valuable insights to help devise strategies aimed at enhancing the allocation, functioning, and realization of equitable access to essential services and infrastructure.

Status of Operationalization, Allocation, and Actualization of the Equalization Fund

Operationalization

The establishment of the fund in 2010 set the stage for its launch in 2012 with the enactment of the Public Finance Management (PFM) Act No.18. The PFM Act delineates the fund’s sources, goals, administration, management, and the formation of the Equalization Fund Advisory Board (EFAB). The board, established through Gazette Notice No. 1711 of 2015 and led by the Principal Secretary at the National Treasury, is tasked with supervising the execution of the fund. The Board works in conjunction with co-opted members and committees in marginalized areas to pinpoint projects suitable for funding. Set to operate for 20 years, the fund seeks to address service delivery challenges experienced in marginalized regions.

The Commission for Revenue Allocation (CRA) adopted policies guiding the operationalization of the fund. The first policy introduced in 2013 outlined the criteria for identifying marginalized counties and recommended procedures for utilizing the Fund as outlined in Article 204. This policy primarily focused on allocating funds to counties based on the County Development Index (CDI), which considered factors such as historical injustices, poverty levels, infrastructure conditions, and access to essential services. Fourteen (14) counties (Turkana, Mandera, Wajir, Marsabit, Samburu, West Pokot, Tana River, Narok, Kwale, Garissa, Kilifi, Taita Taveta, Isiolo, and Lamu) were identified as marginalized, making them the initial beneficiaries of the fund. However, the policy failed to consider variations within each county, had limited public participation in project identification, and delayed timelines in project implementation.

To rectify these issues, the CRA introduced a second policy in 2018 that focused on identification of marginalized areas within sub-counties. The commission devised a deprivation index based on access to water, education, sanitation, and electricity, ranking 7,131 areas from most to least deprived. 1,424 areas were identified as marginalized areas from the ranking, expanding the scope from 14 to 34 counties. The added counties included Baringo, Bomet, Bungoma, Busia, Elgeyo Marakwet, Homa Bay, Kajiado, Kisumu, Kitui, Laikipia, Machakos, Meru, Migori, Murang’a, Nakuru, Nandi, Samburu, Siaya, Tharaka Nithi and Trans Nzoia. However, it would be important to identify and implement targeted programmes considering the gaps in access to various amenities such as transport and electricity across Counties.

Allocation

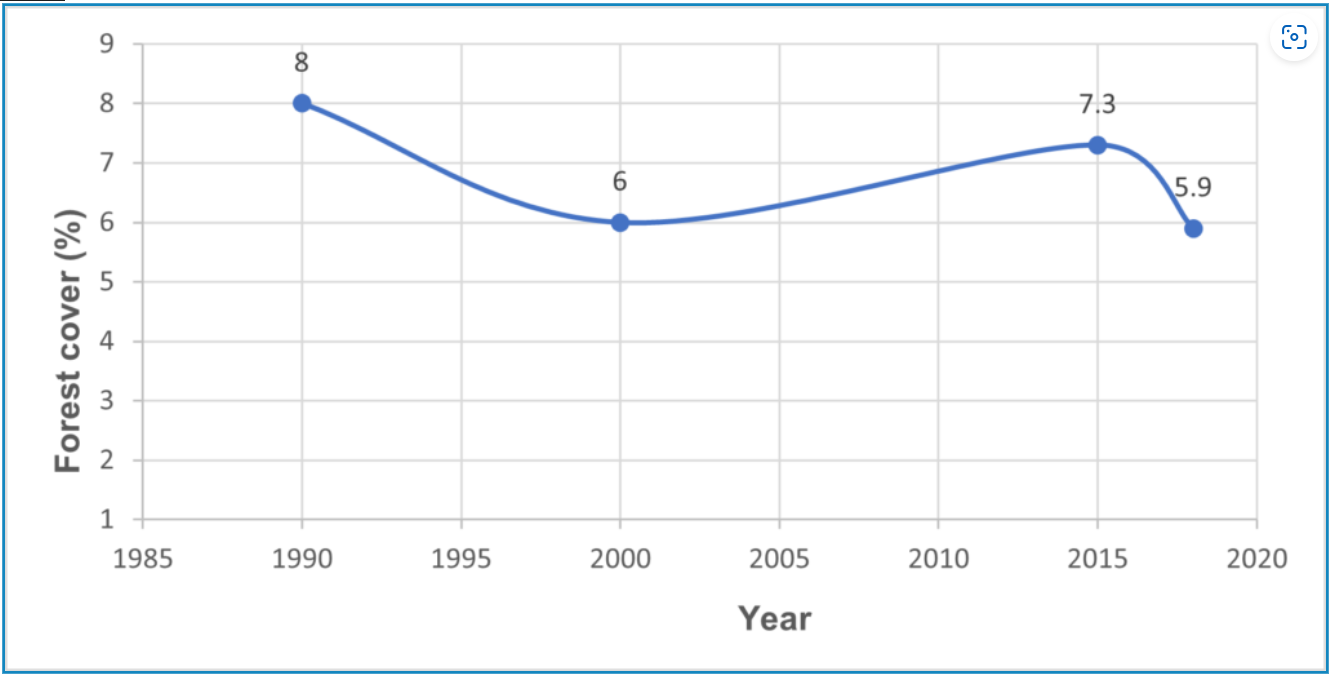

In March 2023, Parliament approved an appropriation of Ksh 13.9 billion for the Equalization Fund, covering the fiscal years 2021/22 and 2022/23. This fund aims to stimulate development in 34 counties that have marginalized areas, as shown in Figure 1. With this disbursement, the total amount disbursed since the establishment of the fund is Ksh 26.3 billion, which accounts for 48.66% of the total entitlement of Ksh 54 billion. During the first three fiscal years (2011/12, 2012/13, and 2013/14), no allocation was made due to absence of a policy to guide the identification of marginalized areas.

Figure 1: Equalization Fund amount appropriated, 2023

Source: The Equalization Fund Appropriation Bill, 2023

Actualization

The performance of the Equalization Fund in terms of actualization is below average, with a performance of less than 50%. The total entitlement to the Fund since its establishment is Ksh 54 billion, but Parliament has only approved a total allocation of Ksh 26 billion (as shown in Table 1). Out of this approved amount, only Ksh 12 billion was appropriated through the Equalization Fund Appropriation Act 2017, with subsequent re-appropriation in the Equalization Fund Appropriation Act 2018, revealing gaps in implementation. The inadequate national revenue contributes to this low disbursement rate from the Equalization Fund by the National Treasury. As a result, the fund’s objectives are severely hindered. Marginalized communities still lag in development compared to the rest of other communities.

Table 1: Equalization Fund entitlement and allocation since inception

| Financial Year | Most recent audited revenue approved by National Assembly | Equalization Fund entitlement (0.5% of most recent audited and approved revenue) (million Ksh) | Equalization Fund allocation (million Ksh) | |

| Base year for most recent audited revenue approved by National Assembly | Audited and approved revenue by National Assembly (billion Ksh) | |||

| (a) | (b) | (c) | (e)=0.5%*(c) | (d) |

| 2011/12 | 2008/09 | 468. 15 | 2,340.76 | 0 |

| 2012/13 | 2009/10 | 529. 30 | 2,646.5 | 0 |

| 2013/14 | 2009/10 | 529. 30 | 2,646.50 | 0 |

| 2014/15 | 2009/10 | 529. 3 | 2,646.50 | 400 |

| 2015/16 | 2012/13 | 776.9 | 3,884. 50 | 6000 |

| 2016/17 | 2013/14 | 935.65 | 4,678.27 | 6000 |

| 2017/18 | 2013/14 | 935.65 | 4,678.27 | 0 |

| 2018/19 | 2013/14 | 935.65 | 4,678.27 | 0 |

| 2019/20 | 2014/15 | 1038.03 | 5,190.18 | 0 |

| 2020/21 | 2016/17 | 1,357.70 | 6,788.49 | 0 |

| 2021/22 | 2016/17 | 1,357.70 | 6,788.49 | 6,825.32 |

| 2022/23 | 2017/18 | 1,413.69 | 7,068.47 | 7,068.47 |

| Grand Total | 10,807.04 | 54,035.18 | 26,293.79 |

Source: CRA (Division of Revenue Acts 2022, 2021, 2020, 2019, 2018, 2017, 2016, 2015)

Projects Identification, Implementation Status and Challenges

Project identification is guided by the Equalization Fund Allocation Board (EFAB). The criteria for determining eligible projects encompasses various factors: completion of stalled or ongoing projects, projects with benefits spanning multiple constituencies, projects outlined in the County Integrated Development Plan, financially viable projects, initiatives targeting extreme poverty alleviation, and projects geared towards fostering growth and job creation within the county. Implementation of the first policy began in 2016/2017. EFAB implemented the fund directly through line ministries as opposed to CRA’s recommendation on transferring the fund to County governments as conditional grants.

The implementation report reveals that only 32% of the planned Equalization Fund projects have been completed, with 112 out of 352 projects finished (Table 2). The low implementation rate is attributed to factors such as the tendering process, where only 52% of tenders have been awarded. The projects mainly focused on water, health, and roads, with the Ministry of Water and Sanitation, Ministry of Health, and State Department for Infrastructure leading in their respective percentages.

Table 2: Status of Equalization Fund Projects

| Implementing MDA | No. of projects | Tendering Awarded | Stalled /not started | Inception | <50% | 50%-75% | 76%-99% | 100% (Completed) |

| Ministry of Health | 84 | 11 | 2 | 0 | 7 | 19 | 35 | 10 |

| State Department for Infrastructure, through KeRRA | 84 | 7 | 8 | 0 | 8 | 22 | 12 | 27 |

| State Department for Irrigation | 24 | 0 | 0 | 0 | 0 | 1 | 2 | 21 |

| Ministry of Water and Sanitation | 128 | 0 | 6 | 0 | 30 | 20 | 35 | 37 |

| State Department for Technical and Vocational Training | 2 | 0 | 0 | 0 | 1 | 1 | 0 | 0 |

| State Department for Early Learning and Basic Education | 10 | 0 | 0 | 10 | 0 | 0 | 0 | 0 |

| Ministry of Energy | 20 | 0 | 3 | 0 | 0 | 0 | 0 | 17 |

| Total | 352 | 181 | 19 | 10 | 46 | 63 | 84 | 112 |

Source: National Assembly (2021)

Note: KeRRA- Kenya Rural Roads Authority

Conclusion and Recommendations

The Equalization Fund exhibits potential in addressing regional disparities and promoting inclusive growth in marginalized areas of Kenya. However, concerns about its adequacy in meeting the diverse development needs of these regions have been raised. As the fund’s expiration approaches, challenges in funding allocation and inadequate revenue have hindered the full attainment of its objectives. Consequently, successful implementation requires collaboration among key stakeholders, including the Equalization Fund Advisory Board, National Treasury, the CRA, County Governments, and Parliament.

The key recommendations are as follows:

- The government could bridge the implementation gap through 100% allocation of the entitled funds. The National Treasury, Kenya Revenue Authority, and County governments could devise effective mechanisms for resource mobilization to increase national revenue, translating to a wider fund’s resource base. Furthermore, it is critical to ensure timely disbursement of equalization funds.

- EFAB and CRA could ensure accountability and transparency in the utilization of funds through enhanced public participation and continuous monitoring of projects. This could be achieved through fast-tracking CRA’s recommendation on establishment of project implementation units (PIUs) by EFAB, to be tasked with identification and implementation of projects.

- EFAB could consider more stakeholder consultation in project identification and implementation. Public participation ensures a more comprehensive understanding of the needs and aspirations of the marginalized communities fostering ownership, sustainability of projects and proper use of public resources.

- EFAB could fast-track CRA ‘s recommendation on establishing project implementation units (PIUs) at the divisional level with the intention of directly transferring funds to them. This will improve efficiency and reduce potential conflicts and power struggles among stakeholders, including National government departments, legislators, and County governors.

Authors: Caroline Ngari, KIPPRA Young Professional

Mohamed Ali, KIPPRA Young Professional