Introduction

Chapter Eleven of Kenya’s Constitution 2010 outlines the objectives of devolution, including promoting social and economic development and ensuring a fair distribution of national resources. According to Article 209 and 210 of the Constitution, County Governments have the authority to impose levies, property rates, entertainment charges, and other taxes or fees as authorized by an Act of Parliament. This is in addition to the funds received through the Equitable Share of Revenue raised nationally and donors/conditional grants. County governments should therefore explore ways to generate revenue to support their operations and fund local development initiatives through taxation, fees, and other charges for services provided to citizens.

Multiple studies conducted by the World Bank, National Treasury, and the Commission on Revenue Allocation (CRA) have revealed untapped revenue sources in the counties. A 2018 National Treasury study showed that nearly 90% of counties had not fully utilized their potential for Own Source Revenue (OSR), collecting less than 40% of their estimated revenue potential. A CRA 2022 report suggests that if optimal fiscal instruments were used at their full potential, counties would be able to generate Ksh 260.6 billion. To achieve this, there is need for effective policies and collection systems to unlock this untapped revenue potential, allowing counties to allocate more resources to development. Failure to address this policy gap could lead to budget deficits, pending bills, service inadequacies, and hindered overall development. In this blog, we will assess the current state of own source revenue across counties and explore ways to improve collection practices for maximizing revenue generation.

Status of Revenue Collection and Potential Sources

- Status of OSR

According to data from the Office of the Controller of Budgets, counties have consistently failed to meet their Own Source Revenue (OSR) targets in all the fiscal years since the start of devolution (Table 1). This trend is expected to continue in the fiscal year 2022/23, as counties only managed to raise Ksh 28.94 billion during the first nine months (July 2022-March 2023), which is just 49.61% per cent of the annual target. It is worth noting that county governments spent approximately Ksh.190.11 billion or 47.4 per cent of the total budget on personnel emoluments, which explains why county workers often face delays in receiving their salaries when cash transfers from the National Treasury are not timely. These figures highlight the significant gap between revenue generation and expenditure at the county level, leading to challenges in meeting employee payment obligations and potentially impacting service delivery to the public.

Table 1: County OSR analysis

| Fiscal Year | Expected OSR Ksh (billion) (a) | Raised OSR Ksh (billion) (b) | Variance Ksh (billion) (c)= (b-c) |

| 2022/2023 | 58.34 | 28.94* | – |

| 2021/2022 | 60.42 | 35.91 | (24.51) |

| 2020/2021 | 53.66 | 34.44 | (19.22) |

| 2019/2020 | 54.90 | 35.77 | (19.13) |

| 2018/2019 | 53.86 | 40.30 | (13.56) |

| 2017/2018 | 49.22 | 32.49 | (16.73) |

| 2016/2017 | 57.66 | 32.52 | (25.14) |

| 2015/2016 | 50.54 | 35.02 | (15.52) |

| 2014/2015 | 50.38 | 33.85 | (16.53) |

| 2013/2014 | 54.20 | 26.30 | (27.90) |

Source: Office of Controller of Budget

* As per the first nine months of FY 2022/23 OSR Collection

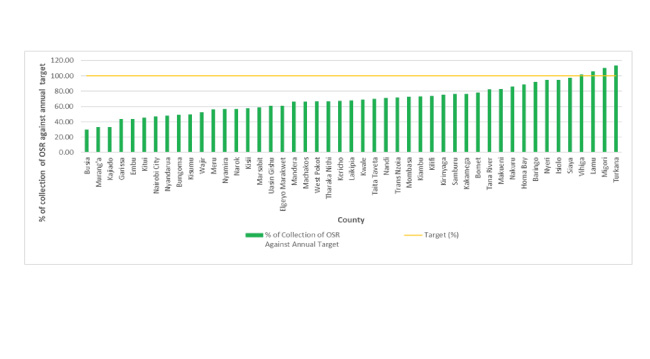

For instance, in the 2021/22, only four counties (Lamu, Migori, Turkana, and Vihiga) achieved their annual OSR targets (Figure 1). In 2020/2021, all 47 counties generated a total revenue of Ksh 34.44 billion, which was 63% of the annual target of Ksh 53.66 billion (Figure 1). This represented a decrease compared to the Ksh 35.77 billion generated in 2019/2020. However, the total expenditure by County governments in 2020/2021 was Ksh 398 billion. This means that the Ksh 34.44 billion generated covered only 11% of the expenditure. As a result, this was sufficient to pay salaries and allowances for only about 20% of the county employees.

Figure 1: Actual revenue collected by the county governments as a percentage of annual revenue target, 2021/22

Source of Data: Office of Controller of Budget

- Actual OSR top streams using top-down analysis

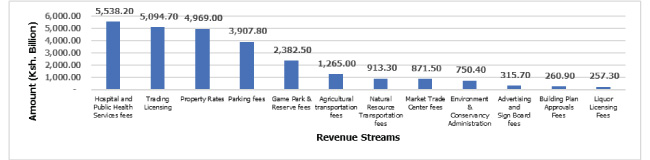

Figure 2 indicates actual own source revenue collection in various streams using top-down analysis. These streams encompass property rates, building plan approval fees, trading licensing, liquor licensing fees, advertising and signboard fees, parking fees, agricultural transportation fees, hospital and public health services, market trade centre fees, natural resource transportation fees, environment and conservancy administration, and game park and reserve fees, which amounted to a total collection of Ksh 28.43 billion.

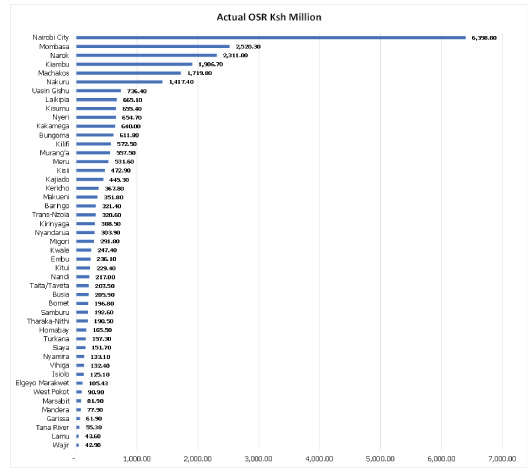

Figure 3 indicates the actual OSR top streams by county, with Nairobi being the leading county with actual collection of Ksh 6,398.80 billion and Wajir having the lowest collection of Ksh 42.90 million.

Figure 2: Actual OSR top streams using top-down analysis, 2021/22

Source: Commission for Revenue Allocation

Figure 3: Actual OSR (Ksh million) by county

Source: CRA (2022)

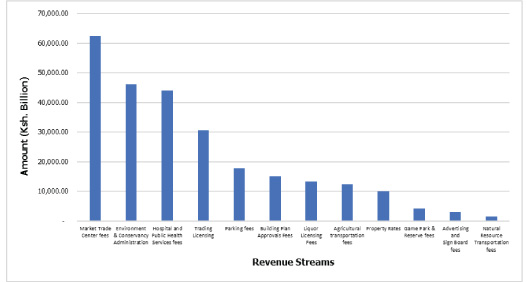

- Estimated OSR potential

Counties in Kenya have the potential to generate approximately Ksh 260.6 billion in Own Source Revenue (OSR) from various streams (Figure 4). Figure 4 indicates the estimated OSR potential streams using top-down analysis. These streams if harnessed for counties would generate more revenue, approximately Ksh 260.6 billion. The streams include property rates, building plan approval fees, trading licensing, liquor licensing fees, advertising and signboard fees, parking fees, agricultural transportation fees, hospital and public health services, market trade centre fees, natural resource transportation fees, environment and conservancy administration, and game park and reserve fees.

Figure 4: Estimated OSR potential top streams using top-down analysis

Source: CRA

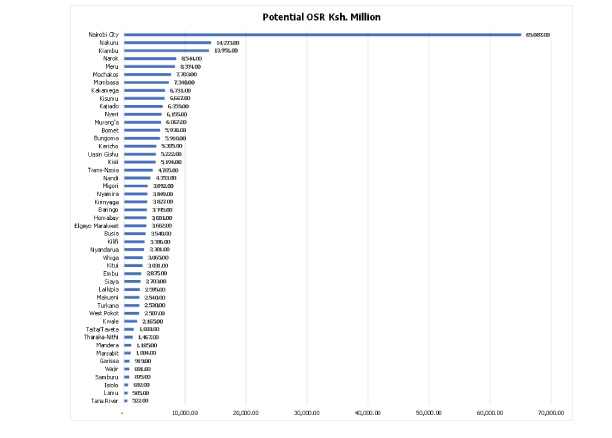

Figure 5 presents the potential OSR top streams by county using the top-down analysis, with Nairobi City County leading by having potential of raising Ksh 65 billion while Tana River County having the lowest potential of raising Ksh 522 million.

Figure 5: Estimated potential OSR top streams by county using top-down analysis, Ksh million

Source: CRA (2022)

Factors Influencing Collection of OSR

- Enforcement of legal and regulatory frameworks

This poses challenges to the collection and management of own source revenue by counties in Kenya. According to the Constitution, the Public Finance Management (PFM) Act of 2012 and PFM 2015 Regulations, each County government is required to have a revenue administration bill that provides guidelines for revenue collection and general administration. Although there is limited information on counties that have enacted the own source revenue bill, the key gaps relate to lack of guidelines to enable counties put more tax effort to tax streams with greatest revenue-raising potential; and the most cost-effective streams to administer such as property tax, building permits, single business permit, parking, advertising, liquor licensing and relevant user charges. Insufficient legal frameworks and guidelines can result in administrative and institutional inefficiencies, hindering the effective collection and management of own-source revenue. It is crucial for the Constitution and county statutes to establish a clear legal basis for counties to raise funds through taxes, fees, and other charges. These frameworks should specify the authority of County governments to impose taxes, fees, and charges for the services they provide.

- Gaps in tax-payer education and sensitization

Gaps in public participation practices in OSR collection in counties contribute to low tax compliance and evasion. According to the Constitution, people’s participation is a key value, and devolution aims to enhance their involvement in decision-making. In this context, taxpayer education plays a vital role in helping the public understand different taxes and levies, promoting compliance, and reducing tax evasion. However, counties lack institutionalized frameworks for tax civic education, including tax sensitization.

- Inadequate staff capacity and poor motivation of revenue personnel

Counties employ inadequately trained personnel responsible for collecting taxes, fees, charges, and rates. Even the limited number of personnel available often lack sufficient training. The effectiveness of revenue mobilization is directly influenced by the training provided to county revenue personnel, as it enhances their understanding and performance of their assigned duties. Additionally, disparities in payment of salaries and lack of structured incentives might also hinder optimal collection of OSR in the counties. The disparities can be attributed to variations in pay structures for staff working on contract. Harmonization of salaries for the staff incentive for overtime work, and adoption of good working spaces for revenue staff would be important.

- Use of manual revenue collection approaches

Manual revenue collection measures have various adverse effects on revenue collection, including a higher risk of errors, delays in collecting revenue, increased operational expenses, elevated potential for corruption, and limited scalability. These systems are susceptible to human errors, leading to financial losses, while paper-based documentation and manual calculations cause delays and hinder cash flow. The manpower and administrative resources required for manual collection result in higher costs. Lack of transparency fosters corruption and fraudulent activities. Moreover, manual systems struggle to handle increasing revenue volumes, leading to inefficiencies. Some counties have automated revenue collection systems. They lack basic data, such as valuation rolls. Where available, the data appear to be neither comprehensive for individual counties and the databases are not harmonized across counties using standardized automated systems.

- Gaps in internal controls and audit systems

Counties lack effective internal controls and auditing mechanisms, which results in inadequate monitoring of revenue. This creates opportunities for staff to spend revenue at source without proper oversight. Insufficient revenue monitoring facilitates misuse, leakage, and financial irregularities by loosening expenditure restrictions, increasing the likelihood of theft, and encouraging unauthorized personal borrowing of funds, resulting to low OSR collection.

Conclusions and Recommendations

A crucial factor in the successful implementation of devolution is the presence of reliable revenue sources that empower County governments to govern and serve their constituents effectively. By boosting Own Source Revenue (OSR), County governments can enhance their financial independence and improve the management of public finances, aligning them with the local economy. This, in turn, enables the timely and smooth delivery of services to citizens.

- Consequently, it is imperative for all 47 County Governments to actively explore comprehensive revenue-generating opportunities to sustain their operations, ultimately reinforcing fiscal decentralization in Kenya.

- It is also necessary for county governments to establish clear revenue administration guidelines, ensuring full compliance with the Constitution, the Public Financial Management (PFM) Act of 2012, and the PFM 2015 Regulations. These guidelines serve as valuable tools for proper execution of revenue-related activities.

- There is need for County governments to implement a training programme focused on enhancing the capacity of revenue collection staff. The “Own Source Revenue Training Guidelines” developed by the Commission on Revenue Allocation (CRA) provide valuable support in improving technical expertise and overall performance. By following these guidelines, County governments can enhance the skills of their revenue staff, supervisors, county assemblies, management, and policy makers.

- Additionally, County Human Resource Advisory Committees need to review compensation packages of staff working in the revenue sections. This, in turn, leads to increased productivity and improved performance of revenue sections within counties.

- It would be important for County governments to actively engage all sectors, stakeholders, and revenue payers when formulating revenue-raising measures and laws. This inclusive process would incorporate diverse perspectives and safeguard the interests of stakeholders. It fosters awareness, ownership, and reduces opposition to tax and fee payments, ultimately boosting compliance. For improved revenue collection efficiency and integrity, it is vital that the National Treasury, KRA, Senate, and Council of Governors (COG) swiftly execute the 2023 recommendations of the devolution conference on enforcing supportive policies and automation of revenue collection system to enhance transparency in revenue collection. This intervention will address challenges such as irregular collections and unscrupulous practices. Through automation, we can expect heightened accuracy and efficiency, achieved by methodically sealing potential loopholes, minimizing remittance delays, and proactively preventing revenue loss in every step of the collection process.

- Furthermore, it is important for counties to establish internal controls such as independent process checks, regular review of audit reports, and evaluation of revenue collection. These measures are vital for ensuring ongoing enhancements in revenue collection, including through maintaining readily available databases, ideally harmonized across counties using standardized automated data management systems. Counties should also aim to share the information across critical stakeholders, including other counties, Kenya Revenue Authority, Kenya National Bureau of Statistics and relevant Ministries such as the Ministry of Lands.

Authors: Mohamed Ali, KIPPRA Young Professional

Caroline Ngari, KIPPRA Young Professional