Introduction

Globally and regionally, the conversation of reducing the reliance on the US dollar as a medium for international trade has gained pace, and it increasingly seems a question of when and not if it is going to happen. At international arena, China and Russian signed agreements that have seen them adopt their local currencies for trade between the two nations. Other countries that have followed a path in their trade include Russia-India, United Arab Emirates-India and China-Brazil. The BRICS, which is a group of the world’s leading emerging market economies, namely Brazil, Russia, India, China, and South Africa have emerged as the strongest advocates for a multipolar world, with the need for an alternative to the US dollar featuring in its 2023 summit in South Africa.

At the regional level, the need to de-dollarize has been driven by the scarcity and heightened demand for the US dollar, which has not only negatively impacted trade but also the domestic economies of African countries. Raising of interest rates by the Federal Reserve has seen capital move from developing countries, leading to depreciation of local currencies against the US dollar. For countries that are net importers, like most in Africa, this has led to spiking of import bills and interest repayments on foreign debt, which is mostly denominated in US dollars. This vicious cycle of capital flight, high import bills and high interest repayment on foreign debt have severely battered regional economies. To reduce on the dollar as a medium of trade, the Pan-Africa Payment and Settlement Systems (PAPSS), a product of the Africa Export and Import Bank (Afreximbank), was innovated with the aim to transform intra-African trade by facilitating cross-border transactions in the local currencies. This will lead to increased intra- continental trade using local currencies, streamlining transactions, and fostering greater economic integration for Africa.

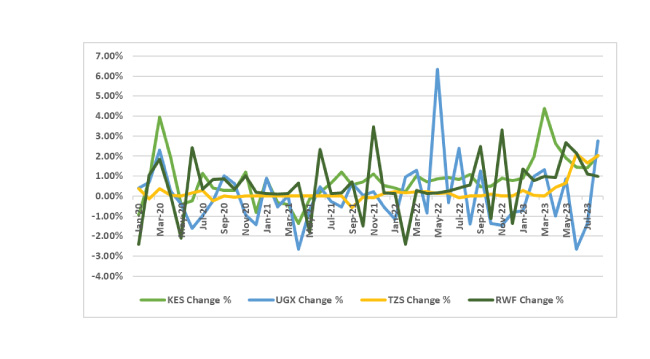

The East Africa Community (EAC) is at the forefront advocating for de-dollarization, with the President of Kenya urging African countries to adopt the use of local currency to enhance cross border trade in East Africa and Africa as a whole. These calls have been majorly driven by the economic disturbances caused by the rapid depreciation of regional currencies against the US dollar. As shown in Figure 1, the Kenyan shilling and Ugandan shilling are the most affected, with fluctuations on depreciation against the US Dollar, with significant fluctuations. However, the Tanzanian Shilling and the Rwandan Franc have showed relative stability, indicating currency stability amid global economic shifts.

These fluctuations have made imports and raw materials very expensive, thus impacting on the cost of living. The decision to adopt a different currency for international trade is not only influenced by the practical need, but also high geopolitical considerations where individual nations’ interests take centre stage. The key question is what potential benefits would accrue to the East Africa Community and what challenges would it face should the bloc head the de-dollarization way?

Figure 1: EAC currency exchange rate fluctuation against the US Dollar

Source of Data: Investing.com

Status with Integration

The EAC member states are aspiring to form a currency union together with the establishment of a mutual central bank by 2024. The idea holds promise for EAC countries. However, it remains a complex issue due to several factors, including the diverse economic structures of member nations, the challenge of fiscal policy harmonization, the pursuit of macroeconomic convergence, and vulnerability to external shocks. The collapse of the East Africa Shilling is evidence enough of the challenges of establishing and maintaining a regional currency. The East Africa Shilling was introduced with the primary objective of promoting economic integration and streamlining trade among member nations. However, the path was challenging, marked by political disagreements and economic disparities among member states, eventually leading to the dissolution of the original EAC in 1977 and the discontinuation of the East African Shilling.

Although there has been significant progress towards the realization of the single currency regime in EAC since the signing of the East Africa Monetary Union Protocols, there are still challenges that impede this process. The fiscal policies among member states differ from one another, thus presenting a challenge particularly in terms of taxation systems, rates, and structures. For example, domestic Value Added Tax (VAT) rates vary, with Kenya taxing at a rate of 16 per cent compared to the rest of the other nations taxing at 18 per cent, affecting the cost of goods and services differently across countries. Another significant challenge lies in the high debt levels of some EAC partner states, with a considerable portion of external debt denominated in dollars. To transition from the dollar, the highly indebted countries would need to substantially reduce their dollar-denominated debt in favour of debt denominated in local currencies. However, this poses difficulties as they would either rely solely on internal borrowing (which is fiscally implausible) or attract foreign investors and institutions willing to lend in local currencies. Unfortunately, foreign investors typically perceive the dollar as a safe currency and may be unwilling to accept local currencies. Moreover, there are no regional and global financial institutions that can provide loans in local currencies.

Macroeconomic convergence is another critical aspect. Member states ought to attain and maintain a maximum headline inflation rate of 8%, maximum budget deficit of 3% of GDP, reserve cover of 4.5 months and a maximum gross public debt of 50% of GDP for at least three consecutive years. So far, the member states still have varying levels of macroeconomic stability, and none are yet to meet all the four criteria.

Vulnerability to external economic shocks is another concern. Fluctuations in global commodity prices and international financial conditions can have far-reaching impacts on EAC economies. EAC countries are heavily dependent on the export of primary commodities such as agricultural products and minerals. Fluctuations in global commodity prices can affect export earnings and terms of trade. Kenya’s tea and coffee exports are sensitive to global price fluctuations. When global prices decline, it can lead to reduced export revenue for these key commodities. EAC countries also often rely on international financial markets for external financing, including loans and foreign direct investment (FDI). Changes in international financial conditions, such as interest rate hikes or reduced investor confidence, can affect their access to capital and the cost of borrowing.

Various lessons can be considered. The European Union Bloc is perhaps the world’s most prominent attempt at establishing a common currency system. Therefore, the EAC member states can learn important lessons from this bloc; one being that the design of the eurozone lacked a backup plan or safeguards for handling crises involving government debt. Also, there is no clear procedure for member states to follow if they have trouble getting access to the markets to refinance their debt. The decision-making requires substantial coordination as 17 sovereign fiscal authorities oversee the euro.

Another important lesson is that, in the absence of thorough coordination of economic policy, depending simply on fiscal and monetary policies is insufficient to ensure sustainability. Similar imbalances could develop inside the EAC, just as they did in the euro area, when different member nations adopted differing structural strategies, leading to a decade long expansion of competitiveness disparities within the region.

It is critical to remember that the euro area crisis highlights the need for a separate central bank to oversee the creation and implementation of monetary policy in the area. The responsible financial laws that control the member nations’ financial sectors must be actively enforced by this central bank. The East Africa Central Bank is planned to be formed along the lines of European Central Bank (ECB). It is therefore key to address the institutional inadequacies of the ECB, such as the lack of mandate to intervene when there is a run on government bonds. Also, there is no crisis management system such as a strengthened European Monetary Fund. There is need for the treaty for the East African Community to spell out safety measures and a bailout plan in case of debt or other fiscal problems among members.

EAC member nations are pursuing various structural strategies and battling difficulties with budgetary sustainability, just as the Eurozone. Although macroeconomic convergence standards have been established, many member nations experience inflation rates that are far higher than the upper limit, in addition to currency volatility. The EAC must strictly adhere to fiscal standards and macroeconomic convergence criteria to prevent making the same mistakes that Europe did.

Conclusion and Recommendations

To successfully achieve de-dollarization, the EAC partner states must address various issues, including focusing on meeting the macroeconomic convergence criteria outlined in the East Africa Monetary Union protocols. This includes endeavours to lower inflation, narrow fiscal deficits, and increase the tax-to-GDP ratio. By enhancing macroeconomic stability and convergence, the region can lay a strong foundation for de-dollarization and foster economic integration.

To tackle the challenges associated with high external debt and the scarcity of financial institutions that lend in local currencies, the EAC should explore the establishment of regional financial institutions capable of providing loans in local currencies. Additionally, efforts should be made to attract foreign investors and institutions willing to lend in local currencies.

To facilitate the currency union, there is need to prioritize the establishment of a regional central bank with strong enforcement powers. This bank should oversee monetary policy, regulate financial sectors, and provide mechanisms for crisis management and intervention when needed.

The EAC could learn from the European Union’s experience and develop clear crisis management mechanisms, including the establishment of a regional monetary fund or financial safety nets to effectively address fiscal problems among member states.

Strengthening regional and global financial networks could help support the trade processes. Thus, there is need to explore partnerships with other regional blocs and international financial institutions to access loans and financial support in local currencies.

Authors: Purity Machio, KIPPRA Young Professional

Powel Murunga, KIPPRA Young Professional