Financial health is an individual’s ability to meet current and future financial needs and wants. Among the characteristics of individuals’ good financial health include high levels of financial literacy, access to financial services and ability to manage finances appropriately. The FInAccess Household Survey of 2021 revealed that adult individuals at the household level had a low-income level, a diminishing savings rate, and high debt insolvency levels. Furthermore, individuals ineffectively used the available financial tools such as banks, mobile money, and savings groups to save for future planned and unplanned financial needs. The diminishing performance in individual financial health mismatched the growth in financial inclusivity as households concurrently registered increased access to and use of formal financial products and services to meet their needs and obligations.

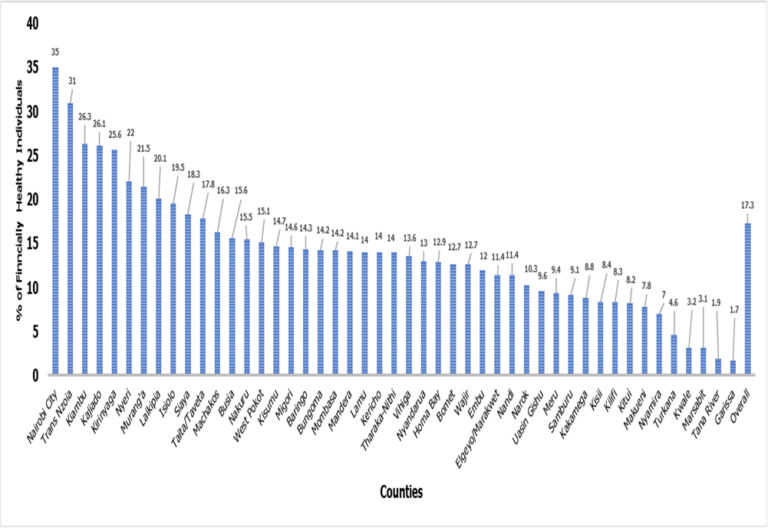

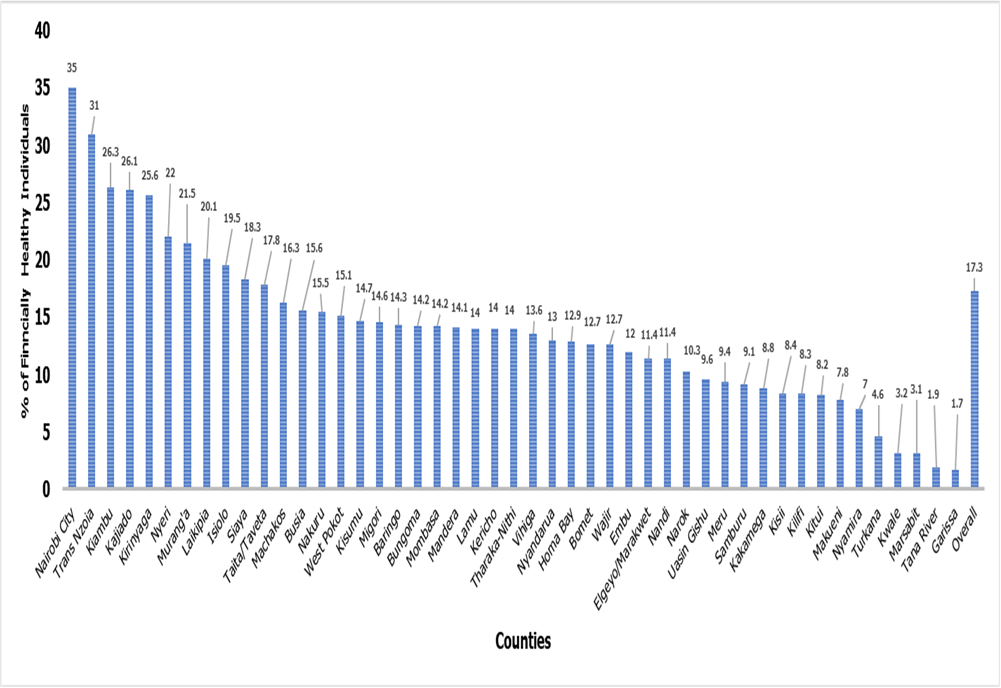

The recent statistics in FinAccess Household Survey 2021 report revealed that on 17 per cent of Kenyans were financially healthy against a financial inclusion index of 83 per cent. This was a 5 per cent drop in the overall financial health index reported in 2019. Out of the 17 per cent healthy individuals, women formed 15 per cent while men were 19 per cent. Individuals living in rural areas registered a financial health of 12 per cent compared to 35 per cent for individuals living in urban areas. Furthermore, the youth (18-35 years) registered a higher index of 18.5 per cent against 17.5 per cent and 8 per cent for the middle aged (36-55 years) and older individuals (over 55 years), respectively.

The declining financial health trend was associated with low financial literacy levels, high debt-income ratio, and low savings rates among Kenyans despite increased access to quality financial services and products. Further, the survey period captured the effects of the COVID-19, indicating low household resilience to shocks. Further, inadequate consumer protection measures and low financial literacy levels were reported to negatively impact on the gains in financial deepening. A low individual financial health translates to economic hardships, exposing them to financial stress, indebtedness, low living standards, and inability to meet daily financial obligations. Increasing financial inclusion presents an opportunity to build individual financial health. Therefore, addressing policy gaps related to financial literacy, access to credit, infrastructure, consumer protection, and regulatory frameworks is crucial to realizing the full potential of financial inclusion for the long-term financial well-being of Kenyan households.

Financial Health Status

Currently, only a quarter of Kenyans are financially healthy (Figure 1). Such a low financial health index of 17 per cent indicates that most Kenyans are financially unstable, hence unable to meet their short-term and long-term financial obligations. Additionally, individuals are unable to respond to unexpected financial shocks. Financial health performance differs among different regions, gender, and age. For instance, most individuals living in Nairobi, Kiambu, and Trans Nzoia counties are financially healthy and financially included compared to those living in Garissa, Tana River, and Marsabit, who are financially unhealthy and have low financial inclusion levels. Individuals from West Pokot County have better financial health performance with low financial inclusion level. Individuals from Makueni and Meru counties performed poorly in financial health despite high levels of financial inclusion. The disparities in the financial health among these counties may be explained by the differences in savings culture, financial habits, income levels and access to resources.

Figure 1: Regional disparities in financial health index 2021 (%)

Data source: FinAcess Survey Report (2021)

Challenges in Access to Financial Services and Products

Increased access to and usage of financial products and services has not eliminated the gaps in financial health. Deteriorating financial health indicates diminishing households’ welfare. Furthermore, the current interventions have only benefited some regions. The arid and semi-arid counties are the most financially unhealthy.

Improved accessibility to financial services and products has increased credit access, but households’ savings rate, uptake of health and life insurance and ability to meet debt obligations remain low. A weak regulatory framework, low financial literacy levels, financial constraints, inadequate infrastructural development, and cybercrimes are some of the existing gaps hindering the gains in financial inclusion.

Weak enforcement of the digital mobile loan lender licensing requirement exposes consumers to financial risks. About 2.5 million Kenyans (1 in 10 adults) have defaulted on mobile loans. An increased number of investors willing to offer unsecured loans exposes the consumers to scrupulous lenders charging high interest rates. Non-payment of this loans reduces consumer’s credit score and diminishes the chance of accessing future loans.

Currently, only 22 digital credit providers out of 381 advertising availability of mobile loans are regulated by the Central Bank of Kenya (CBK). The weak enforcement in the licensing of digital lenders has exposed consumers to unscrupulous lenders charging exorbitant interest on loans. The CBK embarked on licensing the digital credit providers in response to public outcry on unfair blacklisting, high prices and data privacy violation by some fintech companies. However, the remaining 259 digital lenders lack the necessary documentation to obtain licensing from CBK, hence operate illegally.

Increased availability of mobile loan providers has exposed consumers to quick, expensive, and unregulated credit facilities. For instance, mobile loans and digital lenders account for 50.9 per cent and 46.3 per cent of loan sources, respectively. Some of the unlicensed digital lenders prey on unsuspecting consumers and offer loan facilities without clearly stating the terms of reference.

Furthermore, some fintechs are susceptible to fraud and cyber-crime, leading to loss of finances. According to FinAccess Survey 2021, phone fraud accounts for the highest amount of money lost by individuals (53.3% mobile bank users, 25.9% bank users and 26% mobile money users). Cyber-crime accounts for about 6 per cent of money lost by bank and mobile bank users. Lack of strong data protection policies and practices leads to financial losses, especially in Internet banking and mobile phone Apps such as M-Pesa.

Limited information on benefits of financial services and products hinders their uptake. About half of Kenyans receive financial advice from family and friends instead of formal financial institutions. Only about 5 per cent reported acquiring financial advice from formal institutions. Further, some communities fail to recognize the importance of savings and insurance, especially in arid and semi-arid lands. Additionally, low financial literacy levels expose consumers to lousy credit facility choices and financial habits. For instance, sports betting and gambling are considered a form of income earning among the youth.

Unethical debt collection practices among some fintech debt providers expose consumers of these products to unnecessary emotional and financial stress.There have been several cases of threats from mobile loans lenders and unfair blacklisting of consumers by the Credit Reference Bureaus (CRBs).

Despite the gains in technological advancement and infrastructural growth in most regions, there still exists a gap in infrastructural facilities promoting financial access in some regions of the country. Some regions, especially in the ASALs, have weak Internet coverage, thus hindering quality of fintech service provision. Limited access to fintechs affects the citizens ability to save, thus decreasing their chances of improving their financial health.

Conclusion and Recommendations

Improved financial health provides evidence of the desired outcome of financial inclusion. Incorporation of financial health in the financial inclusion framework as a measure of welfare is expected to enhance the financial deepening system. However, low resilience to shocks such as drought, job loss and global pandemics undermine households’ welfare. Building resilience is necessary to achieve the desired outcome of financial deepening. For instance, boosting consumer savings using the available formal institutions will improve their financial welfare. Increasing accessibility to credit facilities without proper regulatory framework will negatively impact on the welfare of consumers fueled by high interest rates and unsophisticated debt collection practices.

There is need to enhance consumer protection to foster positive financial health outcomes for retail customers and medium and small enterprises. For Instance, the Central Bank of Kenya (CBK), Communications Authority of Kenya (CAK), Kenya Consumer Protection Advisory Committee (KECOPAC) and other consumer protection agencies need to work on enhancing the current legal and regulatory framework to safeguard consumers from exorbitant interest rates, data mining, and exploitation.

The CBK could strengthen the enforcement of the Banking Act through continuous regulation and monitoring of digital service providers to ensure compliance to the requirements and standards for licensing. The process will ensure improved quality of services and financial products offered, thereby improving consumer welfare.

Financial literacy can be increased through sensitization and awareness creation. KECOPAC could consider strengthening the current Consumer Protection Act to ensure a clause on digital credit provision; for instance, the clause to emphasize the need for mobile lenders to sensitize individuals on the terms of reference for mobile loans.

Mobile loan service providers could consider establishing a one-stop office with staff representation from the relevant regulators. One-stop shops will promote ease of engagement and improve customer experience.

The CAK could consider strengthening the Communication Act to protect mobile loan consumers from data privacy breach. The Act could capture the role of the digital credit providers in protecting consumers’ data and the penalties for non-compliance to data protection.

The youth should also be cautioned against the dangers of gambling; they should be encouraged to exercise prudent financial habits such as saving. To enhance financial inclusion in areas predominantly inhabited by Islamic communities, the CBK may consider fast-tracking the implementation and adoption of Islamic finance window to regulate the banking institutions offering Islamic financial products. This will in turn boost the confidence of the customers and enhance their access to finance, thus enhancing the well-being of the society.

In partnership with private service providers, the government may consider fully implementing the Internet infrastructure projects to enhance coverage in marginalized areas and increase access to financial services and products. Increase in access to affordable financial services will avail an opportunity for individuals to make informed financial decisions, thereby improving financial health.

By Mohamed Ali and Caroline Ngari, KIPPRA Young Professionals