Small businesses are the driving force behind innovation and economic growth. They are the engine of Kenya’s economy by accounting for 33.8 per cent of the national output (KNBS Economic Survey, 2022). A study by Muturi (2015) found that small businesses have been key in bringing new ideas, products, and services to the market, and at the same time creating job opportunities for individuals with specialized skills. The success of small businesses signals a competitive and dynamic business environment that attracts investment and fosters economic growth. However, the 2016 Micro Small and Medium Enterprises (MSMEs) survey revealed that 46.3 per cent of small businesses closed within their first year of operation. It is disheartening that most small businesses face numerous challenges, leading to high rate of closure.

The Sustainable Development Goal (SDG) 8 recognizes MSMEs’ contribution to ending poverty, hunger and creating decent work. The Bottom-up Economic Transformation Agenda (BETA) envisages the Micro Small and Medium Enterprises (MSMEs) sector to be a catalyst in creation of employment and livelihood opportunities, particularly for the poor and the marginalized groups. The government has supported the growth of MSMEs through initiatives aimed at creating a conducive environment for MSMEs to thrive. Despite the support, the MSME survey report of 2016 indicated that, on average, 46.3 per cent of establishments closed within their first year of operation.

Supporting small businesses to thrive will lead to increased employment, enhanced national output, reduced poverty levels and attract investments in the country.

Current and Past Interventions

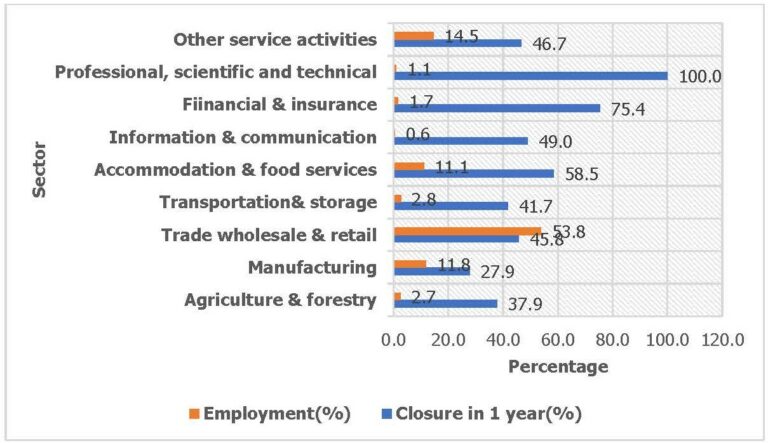

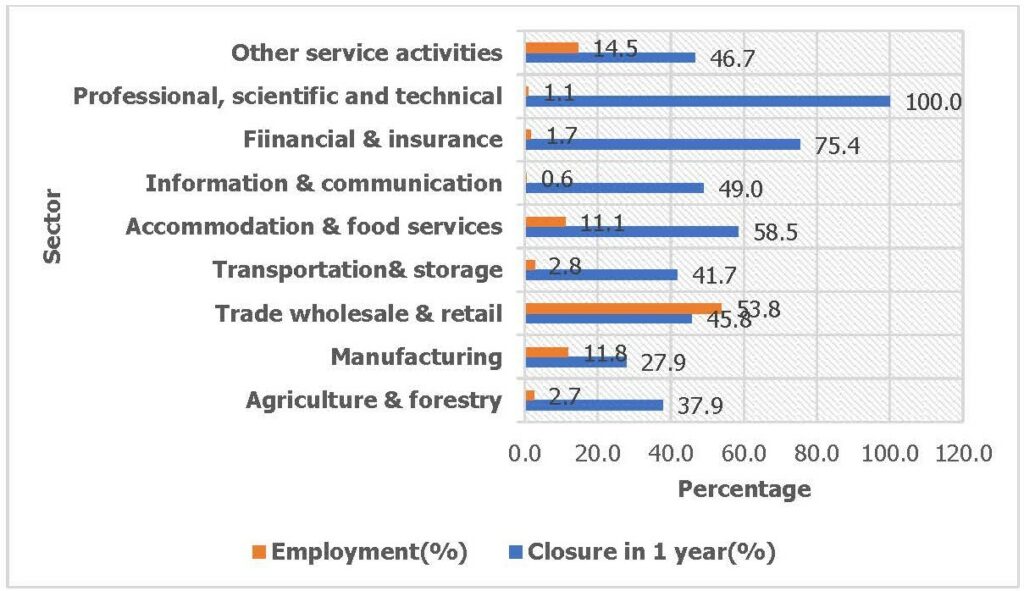

The MSMEs survey (2016) highlighted that wholesale and trade sector contributed the highest employment at 53.8 percent, at the same time it accounted for the highest closure of small businesses (45.8%) (Figure 1).

Figure 1: Distribution of small businesses by closure and employment status (2016)

Source: 2016 MSME Survey data

The government implemented a range of policies and programmes to support the growth and success of small businesses.

Access to finance

To increase access to finance, the government established the Credit Guarantee Scheme (CGS), which incentivized banks to lend more to MSMEs. Further, the government rolled out the financial inclusion fund “Hustler Fund” to promote access to affordable credit to sections of the population who were facing high cost of borrowing to finance their small businesses. The 2016 MSME report found that most of the small businesses in Kenya operate in the informal sector, thus they are not registered or licensed with the government. This makes it difficult for them to access financial services and other forms of support from the government, thus limiting their ability to expand and reach new markets.

The Credit Guarantee Scheme did not address the challenges of affordable, flexible, and accessible credit to MSMEs. The CGS model used commercial banks, thus excluding many small businesses. Many banks preferred allocating their resources to large enterprises rather than to small businesses. The Annual Performance report for the MSMEs Credit Guarantee Scheme (2022) indicated that by June 2022, only 2,490 MSMEs had benefited from the scheme. Inadequate access to finance to most of the small businesses and inadequate knowledge on how to apply for and manage loans remains a big threat to the success of small businesses in Kenya.

Market access

In April 2023, the Government of Kenya and the United States of America successfully completed the second round of negotiations on Strategic Trade and Investment Partnership (STIP). The engagements aim to establish formal binding bilateral agreements that will expand the market for Kenyan commodities. Further, through local, regional, and international trade fairs and exhibitions that have been done, small businesses were better positioned to sell their products.

The World Bank 2018 Enterprise Survey Report indicated that inadequate access to markets for products produced locally affected small business in Kenya. Most of the small businesses faced inadequate customers, leading to business closure. Limited access to markets, both locally and internationally, has been contributed by inadequate marketing skills, poor distribution channels, low access to market information, and limited financial resources to expand businesses.

Working spaces

The Micro and Small Enterprises Authority established 178 Constituency Industrial Development Centres (CIDCs) for small businesses. The CIDCs have been critical in providing equipped facilities to promote a decent working environment for local groups. In addition, the groups received business development services (Sector Report, 2021). Business development services are key in ensuring that small businesses develop appropriate business strategies, manage resources efficiently to remain competitive and attractive to investors and lenders.

Partnerships

Private sector interventions have also continued to increase, all in a quest to provide adequate support for the growth of the SME sector. Mastercard Foundation made a commitment of Ksh 1.5 billion to support a series of interventions aimed at facilitating business continuity, especially for small businesses led and owned by young women.

Conclusion and Recommendations

Small businesses have been crucial for job creation and economic development. The government has made progress in supporting the growth of small businesses. However, the number of small businesses closing within one year is still high. With the growing unemployment rates and the effects of climate change on small businesses, there is need to focus on supporting stability and growth of small businesses.

To improve access to finance, it is important that lending institutions develop specialized products and services tailored to the needs of small business, such as short-term loans, invoice financing, and mobile-based lending platforms. The government may also consider enhancing the Credit Guarantee Scheme to reach more small businesses.

Upscaling capacity building and providing incubation services through business advisory and technical support to small businesses will be of great benefit. This will enhance small businesses to develop strong and comprehensive business strategies that align with their goals and objectives. In addition, capacity building of small businesses will leverage their strengths and unique selling propositions and address their weaknesses and challenges. This will require conducting a thorough analysis of the market, competitors, and industry trends, identifying target customer segments and value propositions, defining clear objectives and performance indicators, and implementing sound financial and operational plans.

Enhanced market access and linkages for small businesses will improve their sales, which can ultimately result in increased revenue. This can be done by organizing with relevant sector-based stakeholders for local, regional, and international trade fairs to provide market linkages for small businesses. The government may also consider mainstreaming the participation of MSMEs in trade agreements, including the Common Market for Eastern and Southern Africa (COMESA), African Growth and Opportunity Act (AGOA, African Continental Free Trade Area (AfCFTA), and Kenya US Free Trade Agreement (FTA), among others.

By By Joseph Nyaramba and Moses Thuranira – KIPPRA Young Professionals