Repositioning Kenya Airways on its Feet Fast

Turbulent times for Africa’s sixth-largest airline, Kenya Airways (KQ) seem far from over. The financial difficulty being experienced by KQ has become even more apparent with the latest profit warning of earnings for the year 2019 when compared to 2018. The airline declared its anticipation of a net loss in excess of Ksh 7.5 billion posted in 2018. Consequently, KQ stock plummeted to a new low of Ksh 2.10 ($0.02) and recorded a -76.97% decline over 2019. KQ financial performance continues to be volatile, with the impact of increasing competition from regional carriers such as Ethiopian and Rwandan airlines, and Middle East carriers such as Emirates, Etihad and Qatar airlines compounding its financial woes.

KQ is operating in a highly competitive environment and has reported a declining dominance in the African skies while the competitors in the region, particularly Ethiopian Airlines and Gulf Airlines are realizing increasing footprint. Ethiopian Airline has over the years reported a gradual growth, currently flying to 153 destinations and operating a fleet of 100 aircrafts while KQ flies to 53 destinations and operating a fleet of 59 aircrafts. This means that the KQ total freight is an eighth of Ethiopian Airline, reflecting the high dominance of Ethiopian Airline relative to KQ. Given the significance of KQ to the Kenyan economy, it requires restructuring towards a growth trajectory, and thus the proposed integrated model that entails delisting, nationalization of KQ and formation of a national aviation holding company is urgent.

Air transport is indispensable for African economies, including Kenya. The International Air Travel Association (IATA) forecasts a 5.9% year-on-year growth in African aviation over the next 20 years, with passenger numbers expected to increase from 100 million to more than 300 million by 2026. The 2017 Air Benefits Report by Convention on International Civil Aviation reported that air transport contributed US$ 72.5 billion to Africa’s GDP and supported 6.8 million jobs, equivalent to 2.6% of Africa’s GDP and 1.8 of all employment in Africa, respectively. IATA projects a double growth of Kenya’s aviation market over the next two years, yielding US$ 11.3 billion boosts to GDP and supporting an estimated 859,000 jobs by 2037. The aviation sector currently accounts for 4.6% of Kenya’s GDP and supports over 410,000 jobs, underscoring the significance of the sector. A profitably operating airline is necessary for Kenya to reap the opportunity in the estimated expansion of the aviation market in Africa.

Founded in 1977 as a government-owned entity following the collapse of the East Africa Community, KQ was the first African Airline to be privatized in 1996. Since its founding and prior to its privatization, KQ had accumulated massive financial losses and crippling debts resulting from government-backed loans issued by financial institutions. The financial losses implied a drain to the exchequer as the government was subsidizing KQ to remain afloat. Therefore, privatization and divestiture of Kenya Airways were indispensable.

The privatization of KQ in 1996 resulted in a restructuring to a 29.8% government ownership from 100% government ownership which yielded efficiency gains, improvement of service standards and a turnaround of the airline’s profits. The airline recorded a 61% growth in flights in a period of six (6) years after its privatization and a doubling of cargo and passenger traffic in a decade. The privatization had a twofold benefit to the exchequer; reduced budgetary support, and tax inflows. Privatization implied that the management was supervised by the shareholders and resulted in management focus on enhancing KQ financial efficiency.

KQ’s journey, unfortunately, has not been all smooth flying since its privatization. Despite being a private company, the government has often shouldered the burden of keeping the airline afloat. For instance, in 2017, the government bailed out KQ from a US$ 243 million debt plus accrued interest owned to the National Treasury, resulting in an increase in government shareholding to 48.9% up from 29.8%. The restructuring resulted in dilution of shareholding by KLM to 7.8%, 38.1% by consortium of local lenders, 2.4% by employee share ownership plan and 2.8% by individual shareholders.

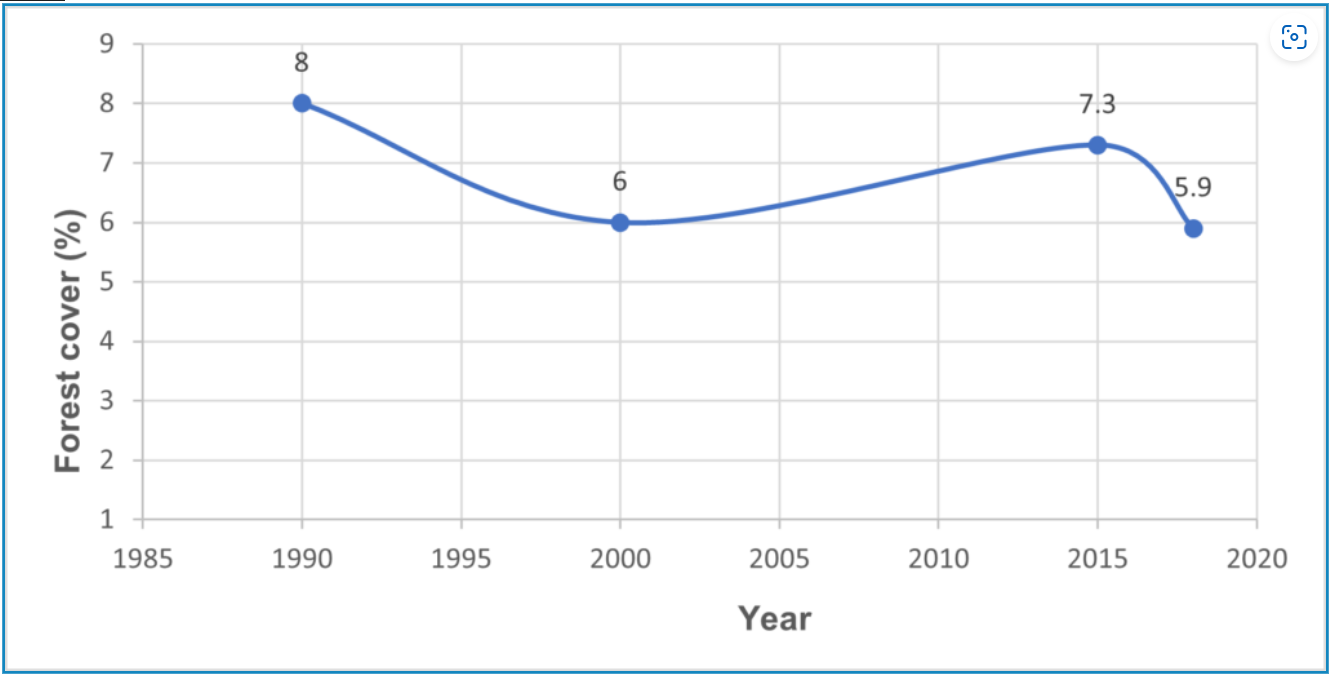

KQ annual reports indicate persistent losses for more than five consecutive years since 2013, recording the highest loss of Ksh 26.2 billion in 2015 and the lowest loss of Ksh 7.5 billion in 2018. However, according to KQ’s annual reports, the airline had reported a positive after-tax profit since its privatization (Figure 1).

KQ after tax profits in Ksh millions

Source: Kenya Airways financial performance sourced from KQ Annual Reports.

KQ has over the years pursued expansionary measures focusing on operational efficiency, cost management, and productivity of human resources. That said, the 10-year strategy “Project Mawingu” has been one of the sources of KQ’s profitability turbulence. The project sought to grow sizeable freighter aircraft fleet expansion from 31 aircraft in 2010 to 120 aircraft by 2020 and destinations from 58 to 115 routes in 77 countries in six continents by 2021 and expand its routes to Asia. The profitability turbulence in 2015, recording a Ksh 26.2 billion loss, resulted in a halt of “Project Mawingu”, including a retiring of two Boeing B737-300 aircrafts.

In addition, KQ’s severe losses were mainly driven by fuel hedging, since the airline’s hedging window 2014–2016 coincided with a drastic dip in global oil prices. The fuel hedging strategy yielded up to Ksh 11 billion (US$ 100 million) loss contributing to Kenya’s corporate historical loss of Ksh 26.2 billion in 2015. KQ’s high operational cost inhibits its profitability. High landing fees, high Airport Pax Service Charge and leasing and servicing costs of the national carrier contribute to persistent losses. KQ pays US$ 430 Airport Pax Service Charge annually to Kenya Airports Authority, which is approximately 50 per cent of KQ revenue. Further, the airline pays US$ 2 million concessional fee, US$ 160 million annual landing fees and US$4 million in building and utility rents to Kenya Airports Authority. An equivalent of 11 per cent of KQ revenue is spent in servicing leases that are double the worldwide average of 5 per cent. While debt restructuring narrowed KQ’s losses in 2018, the airline remains in a financial ditch, necessitating a sustainable turn-around strategy.

Will Nationalization Reverse KQ Fortunes?

Subsequently, a restructuring has been proposed, entailing the re-nationalization of KQ and formation of “Kenya Aviation Holding Company Limited” with four subsidiaries: JKIA Company, KQ, Kenya Airports Authority and Kenya Aviation Academy Limited, a benchmark with UAE, Ethiopia, and Qatar. The restructuring would result in delisting of KQ, overhaul of KQ airline’s balance sheet and its financial liabilities. The restructuring could reduce the risk profile of KQ, which would aid in renegotiating KQ’s aircraft leases, ultimately reducing the operating cost. Operating under holding company, KQ would enjoy concessional rates of taxation, which would facilitate cost-competitive tickets. Currently, KQ pays ground rent, navigation charges, landing and parking fees, service recovery charge and a fuel sub-charge that have an operating cost implication on KQ. The high operating cost is charged to KQ passengers through expensive ticket prices relative to prices by competitors, resulting in empty seats and cancellation of flights, which ultimately affects the airline’s competitiveness. Therefore, adopting strategies to ensure cost efficiencies would enable reduction of ticket prices.

The pro-nationalization arguments are premised on the need to promote social objectives and reduction of inequalities. Notable examples of re-nationalization of private enterprises include the Prestwick Airport in Scotland, Railtrack in the United Kingdom, electricity in California, Steel Industry in France, airport security in the United States, Australia’s telecommunication network, South African mining industry and banking sector in Sweden. The nationalization of the UK railway line (East Coast Mainline and the Heathrow Express) demonstrates that improvement in the quality of service upon nationalization is not immediate. 60 per cent of passenger train delays reported in the UK in 2018 were attributable to publicly owned railway. The Scottish Prestwick Airport which was nationalized in 2013 to save the airport from liquidation is up on sale after running up in debt following six years of operation as a state-owned enterprise. The implications of nationalization of UK railway line Scottish Prestwick Airport imply that nationalization may result in undesirable effects that may result in the need for privatization.

The Bigger Picture

Actual nationalization aside, there is need for proper corporate governance structure of KQ. The 1982 report on government expenditures in Kenya revealed low productivity of public enterprises and identified lack of corporate governance and accountability as a driving factor of the inefficiencies by public enterprises, a challenge witnessed with Kenya Airways. Cytonn Investment 2016 Corporate Governance Index attributed the drop in KQ share price to corporate governance issues, yielding operational inefficiencies and failure to counter competition.

It bears mentioning that examining the risks implication of nationalization of private enterprises is paramount. Inherent risk of nationalization includes declining innovativeness and competitiveness, high staff turnover and “brain drain”, and increased public debt levels. To mitigate such risks, it is important that government aviation investment priorities seek to realize allocative efficiency and innovativeness of the airline. The airline would need to incorporate new technologies into its operations that would, in turn, boost productivity and competitiveness. Moreover, unlike private sector ownership which is open to democratic scrutiny, nationalization of KQ risks implementation of politically expedient solutions. Good governance and effective regulators are inevitable for success irrespective of the ownership. The government would need to institute checks and balances to defend the neutrality in management and ensure minimal political interference.

Moving forward, Kenya should embrace aviation treaties to strengthen nationalization strategies. The Yamoussoukro Declaration to which Kenya is a signatory, advocates for open skies among African countries. The Declaration when fully implemented will prompt de-regulation of the industry, resulting in new routes, increased frequencies, shorter travel times and lower fares which yield economic growth and greater job creation. In addition, implementation of the Yamoussoukro Declaration in Kenya was estimated to yield 15,900 additional jobs

Conclusion

The key challenges for KQ include but not limited to high operating costs, inefficient fuel hedging strategies, inadequate corporate leadership and governance.

It is therefore evident that beyond the nationalization strategy, corporate leadership, robust network, and infrastructure, price leadership are the fundamental strategies that would expand KQ footprint, establish Nairobi as the aviation hub of Africa, and yield the bigger economic gains of air transport. Reinforcing the leadership and governance structures of the national carrier will greatly improve the bottom line, hence mitigate losses. In addition, it is expected that the reviewed booking policy and guidelines will address the challenges facing KQs expensive ticket prices and enhance firm competitiveness.

By Stella Mutuku and Simeon Tunje