Introduction

Financial technology (fintech) automates and improves the delivery and usage of financial services. It enables businesses and individuals to effectively carry out operations and financial transactions using specialized coded software and algorithms used on computers and, more increasingly, on smartphones. Such computer programmes and technology enable banking and financial services to better unbundle their products and services, thus creating new markets for them. This technology enhances financial inclusion and reduces the operational costs of users.

In Kenya, the use of financial technology has enhanced financial access from 82.9% in 2019 to a high of 83.7% in 2021 (2021 FinAccess). The quality and use of fintech products and services are seen to deepen over time. This is mainly driven by increased adoption of fintech innovations by users, diversified use of financial services and products, government policies, and private sector strategies that promote and incorporate financial technology. Technology has, therefore, become a key equalizer between women and men, almost closing both the gender and the rural-urban gap across counties, albeit the marginal negative impact of the COVID-19 pandemic on the financial inclusion landscape.

Policy Issue

Despite the gains that lie in fintech, there is a considerable percentage of Kenyans, approximately 16.3%, who are yet to experience the liberating effects of financial technology in enhancing their access to finance. Kenya’s FinAccess Index stands at approximately 83.7% as of the end of 2021. Of those excluded, the FinAccess report shows that the adult population without access to any kind of financial product/service in a period of 12 months ending September 2021 slightly edged up to 11.6% in 2021 from 11.0% in 2019. This situation was partly worsened by the COVID-19 containment restrictions, which made it difficult for some of those young adults who turned 18 years to register and acquire national identity (ID) cards, a key requirement for accessing and registering for financial products. The exclusion of potential users and potential enhancement of better fintech innovation calls for policy-oriented approaches to ensure that fintech use is enhanced and well-regulated to result in an innovation-friendly and win-win situation for both the implementers and the users.

The Information and Communications Technology (ICT) Sector Statistics Report for 2021/22 details the performance indicators and trends for the period between 1st April and 30th June 2022 in the telephony and data/Internet services. The statistics indicate a positive trend in technology spread and the immense potential for Fintech growth. This potential can be realized if the industry can leverage the existing elaborate and vast network created by technology and Internet availability.

Progress and Current Interventions

Growth in financial technology and innovations across mobile money and mobile banking have greatly enhanced FinAccess in Kenya. Kenyans are now able to access multiple providers of formal and informal financial services/ products – formal being those offered through legally registered providers operating under government-provided regulations while informal financial services are offered through various forms not subject to registration nor government regulation but with mostly a well-defined organizational structure. Financial access in Kenya is, however, increasingly becoming formalized due to the increased adoption of financial technology, mainly mobile banking and mobile money, and reducing the usage of informal modes of financing such as Chamas.

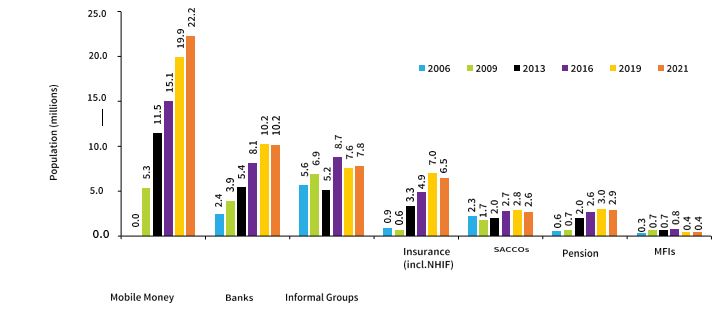

Mobile money, compared to traditional financial institutions, serves the highest number of consumers at 22.2 million, out of 27.3 million sampled by the 2021 Finaccess survey. This shows that fintech growth and use is increasingly becoming useful and popular with the masses, more than the traditional modes of financing.

Figure 1: Usage of Financial Providers by Population

Source: 2021 FinAccess Household Survey

The onset of the COVID-19 pandemic led to many Kenyans embracing the use of digital payments for settling bills by using a card or phone, and transacting money directly from phones and bank accounts via the Internet, with many having not carried out such digital transactions prior to the pandemic. This immensely accelerated the adoption of digital financial services.

Fintech development has had various positive impacts realized countrywide. With digitalization, there is improved governance as some social programmes now channel transfers directly to the beneficiaries’ mobile phones. This reduces money leakages and transactional delays. Transparency is therefore enhanced as money flow can easily be tracked among the senders and beneficiaries, thus reducing leakages and scope for corruption.

Fintech has increased platforms for access to extra funds and credit by increasing money lending apps, driven by the high-profit margin to the lenders, non-stringent rules of operation, and ease of operation, thus making borrowing over the digital platform easy and prompt. One can borrow over various durations of say a week, thirty days, or even 90 days depending on the urgency of the need. Receiving digital payments and remittances via digital platforms further enhances the use of the digital platform to transact, save and even borrow.

Mobile money’s growth has enhanced digital account registration, ownership, and usage for savings, borrowing, and transactional purposes via mobiles. This increases financial inclusion countrywide, and more so among women and marginalized rural communities. The frequency of the usage of mobile money increases too, due to the increased liquidity needs of households and the increased convenience of using it to transact.

Several government policies encourage the use of digital financial services to transact, for example waiver of transaction fees on mobile money transactions in 2020-2021, and the support of innovative mobile money apps with increased security features, lowered cost and increased convenience and ease of money access when using mobile money and bank apps.

Further, several financial policies have been implemented by the Central Bank of Kenya (CBK) and other sector regulators to cushion consumers financially. The CBK Amendment Act 2021 empowered the bank to license, regulate and supervise digital credit providers (DCPs) to ensure a fair and non-discriminatory marketplace for access to credit. Subsequently, the CBK Digital Credit Providers Regulations 2022 issued and operationalized on 18th March 2022 control the financial technology lending space to some extent. Other interventions include the recent suspension of negative listing of loan defaulting borrowers by Credit Reference Bureaus (CRBs), waiver of bank transaction costs, increase in the money transfer sealing/ limit, and further restructuring of loans. All these promote financial inclusion by enhancing the use of digital platforms while cushioning households from the effects of the COVID-19 pandemic and economic shocks.

Other fiscal and administrative measures that further enhance fintech growth while cushioning the economy during the COVID-19 pandemic were tax reductions and waivers, settlement of pending bills to suppliers of goods and services, increasing tax relief offered and effecting social transfers to the vulnerable and severely affected groups. With these, the financial liquidities of households increased, enabling them to transact more using fintech platforms.

Gap Analysis

In Kenya, deterrents to full-blown fintech growth and use could be attributed to, among others, limited ownership of smartphones among some residents, especially in rural areas; unverifiable National Identity (ID) cards, which results in many adults being excluded from financial services; limited knowledge of the operations of various financial facilities and apps among users; unaffordability of Internet by some users; poor Internet and connection infrastructure network in some marginalized areas; low levels of regular income due to economic down times, and job losses mainly occasioned by COVID-19 pandemic, reducing the need, dependency and sustainability of a formal stream of finances. Other deterrents are the high-cost implications of operating a bank account and digital money platforms; low income/savings ability; having an outstanding loan; and no credit history and negative listing by the Credit Reference Bureaus. These forestall the growth and impact brought about by Fintech.

Moreover, there are still regulatory problems and challenges regarding fintech funding, which require well-structured modalities of operation to limit extortion of users by financial firms. There is need to enhance consumer protection and regulations that promote safe, modest, and fair practices by financial companies, protecting consumers from being swindled of money.

Recommendations

To build on the encouraging trends made by fintech, there is need to expand access to finance to the marginalized areas and lowest cadres of society by further reducing the cost of digital transactions, increasing Internet infrastructure in such areas, and continuously channeling wage payments and social transfers through accounts and via mobile money. This will enhance fintech deepening while moderating the effects of current high inflation, COVID-19, slow economic growth, and food scarcity affecting vulnerable groups.

The government could further encourage a shift in the policy environment more so with regard to the increased use of mobile-linked financial platforms compared to the traditional systems of banking. The provision of affordable, ubiquitous Internet access is also critical to fintech growth and progress. On the policy front, a successful model for universal identity that enhances safety and privacy needs to be developed. Financial systems could also be interoperable, with the capability to further lower the cost of financial transactions. To foster safe and fair operational practices by financial and technological companies, lawmakers need to further conceptualize watertight consumer protection and stable regulations on operations.

The government may further promote the digitalization of payments by incentivizing private businesses to settle payments electronically. Such digitalization will further increase formal employment and enhance tax compliance, therefore broadening the government’s tax base.

There is need for policy makers to make additional efforts in conceptualizing policies to include underserved populations and marginalized groups in the ongoing digital revolution and in its sensitization, for instance through women and self-help groups. Although the gender gap in access to finance has narrowed, it still exists. Women, along with the poor in society, are more likely to lack identification documents; a cell phone capable of operating a money account; live further from a bank branch or have limited access to commercial town centre; and need training and education on how to open and effectively use a financial account.

The government could further support financial inclusion through digitalization by promoting knowledge on financial inclusion, supporting the development of new financial technologies, boosting cell networks, reducing Internet costs, improving Internet connectivity around the country, removing regulatory barriers to foster access to finance, adopting e-government platforms across ministries, and digitalization of social protection initiatives.

Authors: Valentine Michuki, Young Professional and Kevin Goga, Young Professional

The featured image is courtesy of Quantum Trading, https://quantumaitrading.net/