The collapse of retail chain giants in Kenya: Evidence and lessons for retailers

Whenever we talk of retailer’s death, the first thing that comes into mind is the shutdown of Nakumatt Holdings. Meanwhile, other retailer chains that have been struggling to stay afloat and at the brink of collapse are Uchumi, Choppies, among others.

The wholesale and retail sub-sector is the 5th largest contributor to Kenya’s GDP and the 3rd largest contributor to private sector employment. In 2016 alone, the sector employed 238,500 people and contributed about 8.4 per cent to Kenya’s GDP.

Since the supermarkets in the country form a significant component to the wholesale and retail sub-sector, dismal performance as witnessed in the recent past is something that needs to be taken seriously. Closure by the giant retail outlet affected both the shareholders and the employees, who lose jobs adding to an already growing pool of unemployed.

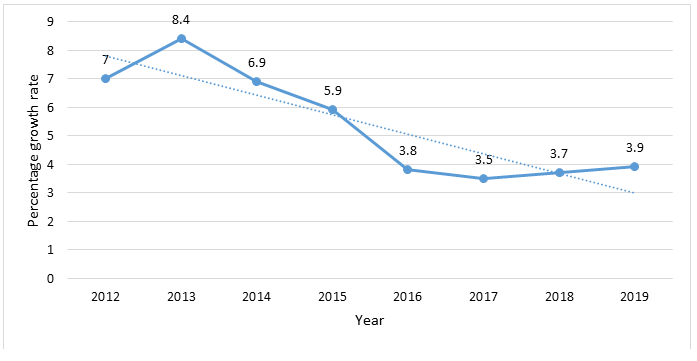

Looking at the data of wholesale and retail sector since 2012, all is not well and there is need for immediate intervention. There has been a consistent decrease in performance as can be seen by the reduction in the growth rate. The highest growth rate was recorded in 2013 and later followed by a consistent decrease until 2017. However, the sector is witnessing slight improvement for the last two years as can be seen in Figure 1.

Figure 1: Wholesale and retail sector growth rate in Kenya

Source: KNBS statistical survey

There are many factors cited as having contributed to the death of Kenya’s retail giants. These factors include gross mismanagement, poor financial decisions, tax compliance issues and massive losses. The losses were attributed to wayward employees and suppliers who perpetrate theft by taking stocks and major assets belonging to the retailers. In other instances, directors are cited as the major reason for underperformance. For the case of Nakumatt, for example, directors took billions of shillings as soft loans, sending the retailer to its deathbed.

Nakumatt Holdings encountered management issues while at the peak of its operations in Kenya. At the time, Kenya’s biggest retail giant had over 60 outlets across East Africa and was making, on average, revenue totaling US$ 700 million annually. The report from the management on dismal performance of the supermarket caught many by surprise in 2016, when the management indicated that the company was facing financial problems, a factor that contributed to operational meltdown. The situation went from bad to worse as the number of outlets dropped from 60 in February 2017 to six in September 2018. The remaining outlets were later sold to Naivas Supermarket at a cost of US$ 4.2 million.

At the time of closure, it was reported that Nakumatt was in a debt crisis as it owed its creditors about US$ 380 million, a factor that made it very difficult to salvage the situation. Amid the financial crisis in 2018, the company entered voluntary supervision to seek protection from its creditors under Kenya’s newly enacted corporate laws. The legislation provides a pathway for distressed firms to avoid complete collapse.

Ukwala supermarket, which began operations in 1995, applied for liquidation citing financial difficulties in the increasingly competitive retail market. At the time, the supermarket owed Ksh 1 billion to 300 suppliers. The supermarket closed down, selling some of its outlets to Choppies. Choppies acquired 75% of the shares, buying ten of its stores. Choppies later also cited financial problems and applied for liquidation four years after it began operations in the country.

Although most of the supermarkets have been citing financial problems in their operations, management disputes and poor financial decisions have also played a part in bringing down most of them. A good case in this regard is Nakumatt supermarket where a recent review of its financial statements by independent auditor Parker Randall Eastern Africa indicated that the company had lent over Ksh 1 billion to its directors in interest free soft loans.

However, the operating environment in the Kenya retail market does not spell doom for all the firms as can be seen from several cases. Currently, Tuskys supermarket have gone on a spending spree opening more outlets in different regions in the country to cement its position despite intense competition from foreign firms that are gaining dominance at an increasing rate. Currently, the supermarket owns about 60 outlets, making it one of the supermarkets with the biggest portfolio of outlets in the country.

Another retail outlet that has shown significant improvement is Naivas supermarket. To increase its dominance in the country, it has increased the number of outlets, which currently stands at 50. The supermarket has also increased its campaigns, offering different products to its customers in the country. Currently, Naivas is Kenya’s biggest online retail supermarket.

Experts in retail outlets hold a different view on why there is persistence in dismal performance by various supermarkets operating in the country. At the time of closure, Nakumatt supermarket directors indicated that intense competition may have played a significant role in the collapse of the retail giant. They indicated that the battle for the limited group of middle-class shoppers witnessed between locally-owned and foreign supermarkets has been increasing at an alarming rate, forcing the firms to adopt practices such as price cutting, therefore affecting the profitability by the firms.

In the recent past, foreign supermarkets have been opening shops in Nairobi and other regions in Kenya and East Africa. The international supermarkets that have joined the East African region despite intense competition include Massmart, through its Game Stores, Shoprite from South Africa and French retailer Carrefour, all cementing their respective positions.

The increase in the number of foreign-owned supermarkets in the country has serious implications to the locally-owned outlets. Despite the increased competition, local players do more to match the deep-pocketed multinational firms that have brought with them sophisticated supply chains and exclusive online shops. It has also been argued that presence of global retailers in the Kenyan market has major benefits especially to the suppliers and the creditors. Since they have superior financial muscle as compared to their Kenyan counterparts, these firms have a proven track record of timely payments to suppliers.

According to Cytons, an investment advisory firm, presence of foreign supermarkets in the Kenyan market does not spell doom for the locally owned supermarkets. Foreign firms only constitute a small portion of the total market, with locally owned firms constituting about 85 per cent. Local firms will therefore continue dominating the market, and the presence of foreign firms that are more competitive should not be the reason of failure or why local supermarket are closing shop.

It evident that Nakumatt Holdings collapsed due to mismanagement. In a court hearing, it was discovered that the company’s founder was facing investigations over the loss of over US$ 100 million worth of stock. Its further stated by the independent auditor that Nakumatt lent its directors interest free loans amounting to over Ksh 1 billion. This is an indication of poor management practices, which majorly contributed to the fall of the supermarket. Looking at what happened to Nakumatt, it is important for other supermarkets to concentrate on good management skills since lapses in management drive them out of the business.

The issue of stock and asset theft through collaboration of employees and suppliers was brought about by poor execution of inventory management procedures as a result of poor management. It is important that surviving supermarkets execute inventory management to the letter, with regular stock taking to curb lapses at early stages.

By: Carolyne Mbatia and Abraham Wanjiku